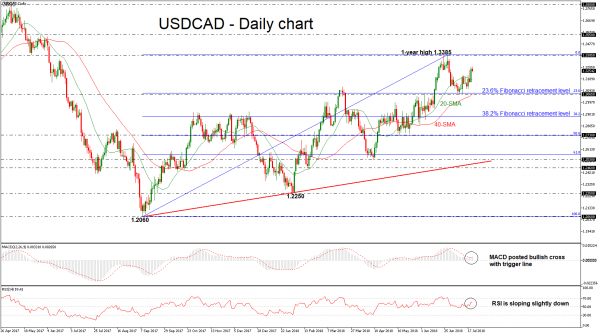

USDCAD recorded a stunning rally on Thursday and continued the buying interest during today’s Asian session towards a three-week high of 1.3289. This week, the pair is in positive territory, so far for the second session in a row, after the rebound near the 1.3065 support that was reached on July 9. However, the momentum indicators seem to be in confusion and the market could ease a little bit in the short-term.

The RSI indicator is currently sloping to the downside, increasing negative momentum. Despite that, the MACD oscillator created a bullish crossover with its trigger line in the positive territory, signaling for a possible upside run.

If the market manages to pick up speed, the one-year high of 1.3385 could offer nearby resistance for the bULLS. A significant close above this level would drive the pair towards the next hurdle of 1.3550 taken from the highs on June 2017.

Conversely, should prices decline, immediate support could be found at the 23.6% Fibonacci retracement level of the upleg from 1.2060 to 1.3385, around the 1.3065 barrier, which overlaps with the 40-day simple moving average (SMA). Then a leg below that level, the price could meet the 38.2% Fibonacci mark of 1.2880.

In the medium-term, the greenback seems to be in a strong bullish rally against the loonie as it has been holding within an ascending movement since September 2017.