Here are the latest developments in global markets:

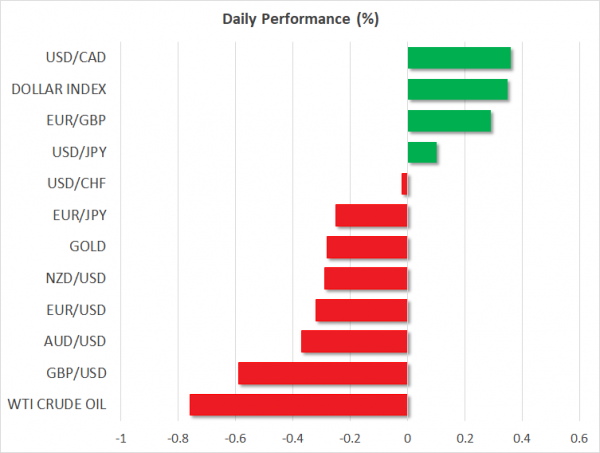

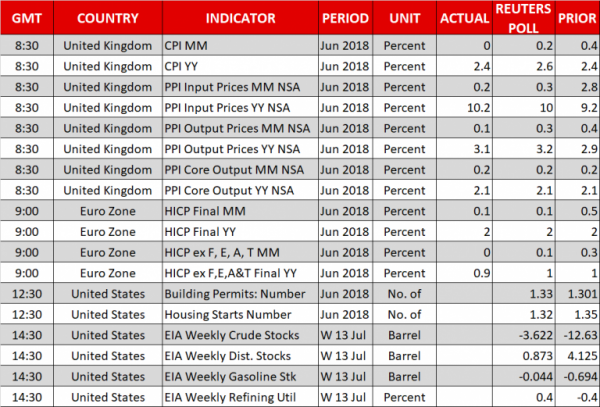

FOREX: The US dollar extended its bullish rally against the Japanese yen towards a fresh 6-month high of 113.13, adding 0.08% to its performance on Wednesday. Markets reacted positively after the Fed Chair, Jerome Powell, gave a bullish assessment of the US economy, reducing their exposure to safer assets such as the yen. Also, the US dollar index gained 0.33% and surpassed the 95.00 handle. Sterling plummeted to 10-month lows (-0.61%) today, pausing at 1.3000 after the UK’s headline inflation stood unchanged at 2.4% y/y in June instead of picking up to 2.6% as analysts had forecasted. Brexit-linked political risks were also weighing in the background. The Eurozone’s final headline CPI figures (harmonized) for June came in line with expectations, though core measures disappointed, sending euro/dollar down to 1.1614 (-0.35%). In antipodean currencies, aussie/dollar and kiwi/dollar were struggling, with the former dropping to 0.7354 (-0.43%) and the latter easing to 0.6759 (-0.35%). Dollar/loonie broke above the 1.3200 key-level to touch an almost 3-week peak at 1.3247 (+0.44%).

STOCKS: European equities jumped after a mixed Asian session on Wednesday, gaining on a weaker euro and positive earnings updates. The pan-European STOXX 600 was up by 0.43% at 1110 GMT with almost every section in positive territory. The blue-chip Euro STOXX 50 traded higher by 0.60%, creating a 1-month high. The German DAX 30 climbed by 0.68%, the French CAC 40 rose by 0.45%, while the Italian FTSE MIB moved down by 0.12%. UK’s FTSE 100 advanced by 0.57%. Futures tracking US stock indices were mixed, with the Dow Jones in the green pointing to a positive open, whereas the S&P and the Nasdaq were in the red, indicating a negative open.

COMMODITIES: Oil was one of the biggest movers over the last couple of days, posting new multi-week lows as OPEC and Russia increased supply while concerns over supply shortages in other places eased. Moreover, the US Treasury Secretary Mnuchin said on Tuesday that some crude importers may receive waivers to continue buying supplies from Iran. WTI plunged further (-0.76%) to $67.56/barrel, the lowest in four weeks after the API weekly report on US crude oil stocks indicated a rise in inventories. Moreover, Brent oil plummeted by 0.80% towards $71.58/barrel, posting a fresh 3-month low. In precious metals, gold dived to a 1-year low on Wednesday, losing 0.34% as the dollar firmed after Powell’s testimony.

Day ahead: Powell testifies before the House Financial Services Committee; US housing data & Australian jobs report pending

The Fed chief, Jerome Powell, will be testifying before the House Financial Services Committee at 1400 GMT today, telling the Senate Banking Committee on Tuesday that the US economy is “growing considerably stronger” to absorb higher interest rates this year even under rising trade risks. Following the testimony, traders will be closely listening to the Q&A session which could find lawmakers challenging Powell’s bullish tone yesterday. A few hours later at 1800 GMT, the Fed will separately publish its Beige Book which tracks the health of the economy based on the its own sources across the nation, while prior to Powell’s speech, US data on building permits and housing starts due at 1230 GMT could bring some volatility to the dollar as well. Analysts believe that building permits increased by 1.33 million in June, slightly less than in May when the figure posted an increase of 1.30mn. Housing starts, however, are expected to ease, falling from 1.35mn to 1.32mn.

In other data releases of notice, Japan is scheduled to release trade stats for the month of June at 2350 GMT. While exports are expected to grow at a slower pace of 7.0% y/y compared to 8.1% in May, imports could post a steeper slowdown, expanding by 5.3% y/y after recording an expansion of 14.0% in the previous month. A fact that could turn the trade balance positive as analysts predict, from -580.5bn yen to 534.2bn yen. Japan’s trade balance with the US and the EU separately could attract greater interest as the country has been subject to US tariffs on Japanese steel and aluminum imports since early June, with Japan refusing to accept a bilateral trade partnership as the US desires, while trade with the EU could operate under fewer restrictions in the future if the EU and the Japanese parliaments approve one of the biggest free trade deals in the world signed between the sides yesterday. Still, as the yen tends to be relatively less sensitive to data releases, the currency is not expected to react much in the wake of the data.

Meanwhile in Australia, investors will be waiting for June’s jobs report early on Thursday at 0130 GMT, which could show that the unemployment and the participation rates stood unchanged at 5.4% and 65.5% respectively. The number of employees, though, could increase by 17k, more than the 12k rise tracked in May. While wage growth is what the RBA mainly wants to see rising, minutes from its latest policy meeting showed that policymakers are optimistic that a tightening labor market could eventually drive earnings higher, helping the indebted citizens to cover their liabilities and at the same time for inflation to accelerate towards the RBA’s price target.

In oil markets, the Energy Information Administrations will issue its weekly report on US oil inventories at 1430 GMT. Yesterday, API figures indicated an addition of 0.62mn barrels in US crude oil stocks, pushing oil prices downwards. Should EIA numbers identify an increase or a smaller decline than analysts are forecasting, the market could face stronger downside pressure. For the week ending July 13, projections are for a fall of 3.622mn barrels compared to a loss of 12.63mn in the preceding week, the largest downfall since September 2016.

In equity markets, earnings season continues with American Express, Alcoa, eBay, IBM being among companies releasing quarterly results after the market closes today.