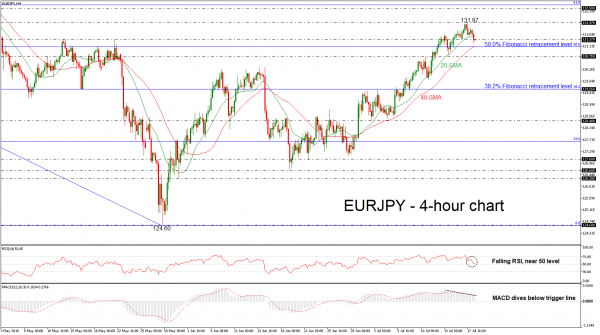

EURJPY started an aggressive bearish rally today after it reached a two-month high of 131.97 on Tuesday. The sharp sell-off creates a new structure of downward correction in the pair as it also fell below the 20-day simple moving average (SMA) in the near-term.

The momentum indicators, in the 4-hour chart, are supportive of the bearish picture, with the RSI falling towards the threshold of 50 with strong movement, while the MACD oscillator is slipping below its trigger line and is approaching the zero line.

The immediate support to have in mind is the 50.0% Fibonacci retracement level of the downleg from 137.50 to 124.60, around 131.10. This level coincides with the 40-SMA in the near term. Should prices drop lower again, the next support could come from the 130.75 level taken from the high on July 10.

In case of an upward attempt, the single currency would retest the two-month high (131.97) against the yen. A break above this significant obstacle would ease the downside correction and open the door towards the 132.50 hurdle where the price topped during April.

Having a look at a longer timeframe, EURJPY is still in a rising mode after the rebound on the 124.60 support and found resistance at the 200-day SMA on Tuesday.