Dollar is regaining some ground as markets await Fed chair Jerome Powell’s Congressional Testimony. But still, New Zealand Dollar is the strongest one today as lifted by inflation data. Swiss Franc trades as the second strongest as European indices are trading broadly in red. There are also speculations that SNB could finally raise interest rate by the end of 2019. Meanwhile, Sterling is trading as the weakest one for today as markets didn’t take the job data positively. Yen follows as the second weakest.

Today will begin Powell’s two-day testimony, starting with Senate Banking Committee. House Financial Services Committee comes tomorrow. Expectation is rather low on the event. Fed’s rate path is clear for the near term, that is two more hikes in 2018. Recent economic data support the path, with solid job market and improving inflation. Powell will most likely reiterate the views as see in the minutes of the June 13 FOMC meeting.

Nonetheless, his views on the topic of flattening or even inverting yield curve might raise some eyebrows. Minneapolis Fed President Neel Kashkari said in an essay released yesterday that ‘This time is different’ are the four most dangerous words, in response to those who tried to talk down flattening yield curve and the link to recession. So, to Powell, it’s this time the same? Or is it different?

Japan and EU signed landmark trade agreement, stand together against protectionism

European Union and Japan signed an unprecedented free trade agreement in Tokyo today. The signing was delayed from last Wednesday, as Japan Prime Minister Shinzo Abe needed to give more attention to the flood in southwester Japan. It’s nevertheless a huge achievement in real terms by the two power houses after four years of negotiations. To name a few of the key points, it’s estimated that Japan GDP will be boosted by 1% with around 290k jobs created. The 10% import duty on Japan car will be dropped. And, the majority of the EUR 1B duties by European exporters will also be removed.

Abe said today that “while protectionism is spreading in the world, Japan and the European Union will take the lead as flag bearers for free trade.” European Council President Donald Tusk said “we are sending a clear message that we stand together against protectionism.”

Sterling in delayed selloff after job data, employment rate hit record but wage growth slowed

Sterling’s initial reaction to today’s job data is rather muted. But markets seemed to make up their mind in delayed selloff. UK jobless claims rose 7.8k in June, above expectation of 2.3k. Average weekly earnings including bonus rose 2.5% 3moy in May, slowed from 2.6% 3moy. Average weekly earnings excluding bonus rose 2.7% 3moy, slowed from 2.8% 3moy. Unemployment rate was unchanged at 4.2% in the 3 months to May, staying a the joint-lowest since 1975. Employment rate rose to record high at 75.7%. UK employment rates (aged 16 to 64 years), seasonally adjusted, January to March 1971 to March to May 2018.

RBA reiterates next move is more likely an increase

RBA minutes of July meeting cleared up some confusions in the market as it stated that “members continued to agree that the next move in the cash rate would more likely be an increase than a decrease.” Still, as the progress of wage growth and inflation will “likely to be gradual, “there was no strong case for a near-term adjustment in monetary policy.” Instead, “the Board assessed that it would be appropriate to hold the cash rate steady and for the Bank to be a source of stability and confidence while this progress unfolds.” Overall, the minutes reaffirmed the tightening bias of the central bank, but the rate hike will only happen at least deep into mid-2019.

On the economy, RBA noted that recent data has been consistent with the central forecast of GDP growth at a bit above 3% over 2018 and 2019. Non-mining business investments had “contributed significantly” to growth in Q1. Public infrastructure investment and business conditions “remained positive”. But consumption “remained a source of uncertainty”. Labor market outlook remain positive for solid growth ahead, with “vacancy rate” risen to historical high. And the conditions will lead to gradual decline in unemployment rate and push up wages.

New Zealand Dollar jumps as RBNZ sectoral factor model CPI improved

New Zealand CPI rose 0.4% qoq, 1.5% yoy in Q2, accelerated from Q1’s 0.5% qoq and 1.1% yoy. The headline number missed expectations of 0.5% qoq, 1.6% yoy. However New Zealand Dollar later reacts to RBNZ’s own prices data. Most notably, the sectoral factor model CPI rose to 1.7% yoy in Q2. There were continuous improvements since last year from 1.4% in Q3 2017 to 1.5% in Q4 2017 to 1.6% in Q1 2018.

The sectoral factor model CPI was created by RBNA to estimate the common component of inflation in the CPI basket, the tradable basket, and the non-tradable basket, based upon separate factors for the tradable and non-tradable sectors. The data excludes GST. It’s one of RBNZ’s preferred core inflation gauge.

USD/JPY Mid-Day Outlook

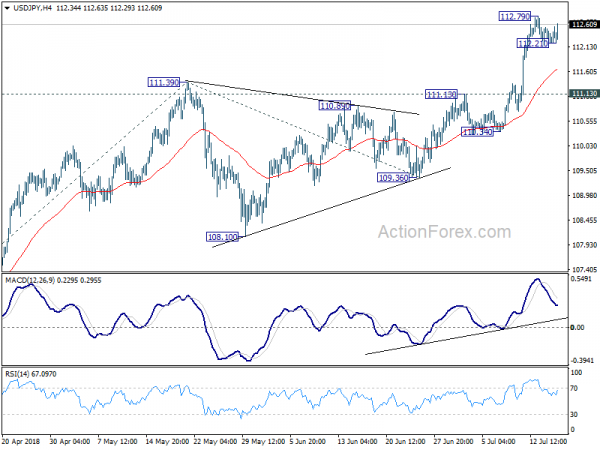

Daily Pivots: (S1) 112.15; (P) 112.35; (R1) 112.49; More…

USD/JPY recovers notably today but stays below 112.79 temporary top. Intraday bias remains neutral first and more consolidation could be seen. Below 112.21 will target 4 hour 55 EMA (now at 111.68). But downside should be contained well above 111.13 resistance turned support to bring rally resumption. On the upside, break of 112.79 will target 61.8% projection of 104.62 to 111.39 from 109.36 at 113.54 first. Break will put focus on 114.73 key resistance for confirming our bullish medium term view.

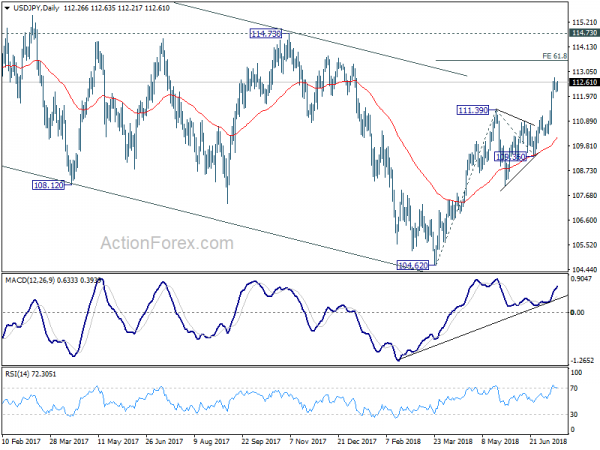

In the bigger picture, current development, with the solid break of medium term channel resistance from 118.65 (2016 high), affirm our view that corrective fall from there has completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will now be the preferred case as long as 119.36 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | 0.40% | 0.50% | 0.50% | |

| 22:45 | NZD | CPI Y/Y Q2 | 1.50% | 1.60% | 1.10% | |

| 01:30 | AUD | RBA Minutes Jul | ||||

| 08:30 | GBP | Jobless Claims Change Jun | 7.8K | 2.3K | -7.7K | |

| 08:30 | GBP | Average Weekly Earnings 3M/Y May | 2.50% | 2.50% | 2.50% | |

| 08:30 | GBP | ILO Unemployment Rate 3Mths May | 4.20% | 4.20% | 4.20% | |

| 12:30 | CAD | Manufacturing Sales M/M May | 1.40% | 0.60% | -1.30% | |

| 13:15 | USD | Industrial Production M/M Jun | 0.50% | -0.10% | ||

| 13:15 | USD | Capacity Utilization Jun | 77.90% | |||

| 14:00 | USD | NAHB Housing Market Index Jul | 69 | 68 | ||

| 20:00 | USD | Net Long-term TIC Flows May | 34.3B | 93.9B |