Expected to be the main driver of market sentiment this week- it’s currently giving a ‘temporary’ break to trade relation tensions amongst G7 economies.

Global equities have drifted lower overnight on mixed earnings, while capital markets await the latest clues on U.S monetary policy.

Today’s focus will be on new Fed chair Jerome Powell’s first testimony before the Senate Banking Committee, where he is expected to give further clues on how fast the Fed is likely to keep pushing U.S interest rates higher. His prepared remarks may ‘not’ be too hawkish, but keep an eye on his Q & A session.

Note: Futures prices are currently pricing in a +62% probability that U.S rates will rise at least twice more this year.

Elsewhere, U.S Treasuries prices continue to slip along with the ‘big’ the dollar and crude oil prices.

1. Stocks mixed results

In Japan, the Nikkei share average rallied to a one-month high overnight as a weak yen (¥112.36) lifted exporters, offsetting weakness in machinery stocks after data showed China’s growth momentum cooling a tad. The Nikkei ended up +0.4%, the highest closing level since mid-June, while the broader Topix advanced +0.9%.

Note: Japanese markets reopened after a three-day weekend due to a national holiday yesterday.

Down-under, Aussie and S. Korean shares fell earlier this morning, as an overnight slump in oil prices and weaker commodities hurt domestic energy and mining stocks. Following Monday’s decline of -0.4%, the S&P/ASX 200 index fell -0.6% at the close of trade, while in S. Korea, the Kospi lost -0.18%.

In Hong Kong and China, same story, equities ended lower overnight, dragged by energy firms following a sharp decline in crude oil prices. The Hang Seng index fell -1.3%, while the China Enterprises Index lost -1.1%. In Shanghai, the blue-chip CSI300 index closed -0.7% down, while the Shanghai Composite Index ended -0.6% lower.

In Europe, regional bourses have opened lower and currently trade sideways. The financial sector remains the best performer in muted volatility, while the tech sector underperforms.

U.S stocks are set to open unchanged.

Indices: Stoxx50 -0.2% at 3,446, FTSE +0.1% at 7,608, DAX flat at 12,562, CAC-40 flat at 5,412; IBEX-35 flat at 9,714, FTSE MIB +0.4% at 21,906, SMI -0.4% at 8,812, S&P 500 Futures flat.

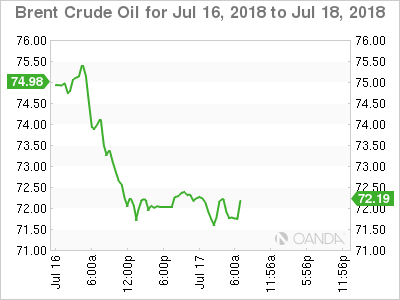

2. Oil prices fall again on oversupply concerns, gold higher

Oil prices remain under pressure as market worries about possible disruptions to supply eased and as investors focused on potential damage to global growth from the Sino-U.S trade squabble.

Brent crude futures have fallen -32c, or -0.5%, to +$71.52 a barrel – the lowest price since mid-April. Prices fell -4.6% yesterday. U.S West Texas Intermediate futures are down -31c, or -0.5%, at +$67.75 a barrel – it too declined -4.2% on Monday.

Note: market volumes at current levels remains poor, which is expected to lead to further slippage.

China this morning said they remain confident of hitting its economic growth target of around +6.5% this year despite market expectations of facing a tough H2 as a trade row with the U.S intensifies.

Note: On Sunday, China reported slightly slower growth for Q2 and the weakest expansion in factory activity in June in two-years.

Crude supply currently is not a market issue. Along with the Saudi’s surge in production, U.S oil output from seven major shale formations is expected to rise by +143K bpd to a record +7.47M bpd next month, according the EIA’s report on Monday.

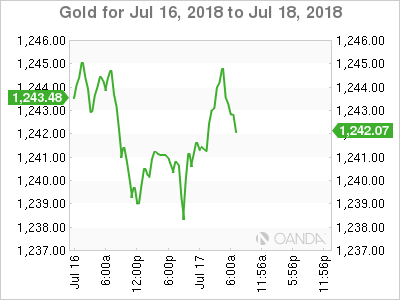

Ahead of the U.S open, gold prices have edged a tad higher as the ‘big’ dollar remains on the back foot ahead of U.S. Fed Chair Jerome Powell’s first congressional testimony. Spot gold is up +0.25% at +$1,243.18 an ounce. U.S gold futures for August delivery are up +0.3% at +$1,243.20 an ounce.

3. Yields little changed ahead of Powell’s testimony

Trading in government bonds remains subdued ahead of Fed Chair Powell’s testimony (10:00 am EDT).

Eurozone government bond yields have inched lower by -0.5 to -2 bps, with the market naturally unwilling to push yields any higher before Powell’s Q & A in a few hours.

Yesterday, the U.S two-year yield edged to a new multi-year high above +2.60% – it has been struggling at this rate for the past two-months.

Note: Current futures prices suggest there is nearly a +90% chance discounted in the Fed funds futures strip of a September rate hike and that there is about a +60% chance of a December hike, which would take the Fed fund target to 2.25-2.50%. If true, that would seem to make the two-year yield still relatively low if one expects at least one hike next year and no cut in 2019.

Elsewhere, the yield on U.S 10-year notes advanced less than +1 bps to +2.86%, the highest in more than two-weeks. In Germany, the 10-year Bund yield fell -1 bps to +0.35%, while in the U.K, the 10-year Gilt yield decreased -1 bps to +1.27%, the lowest in more than a week.

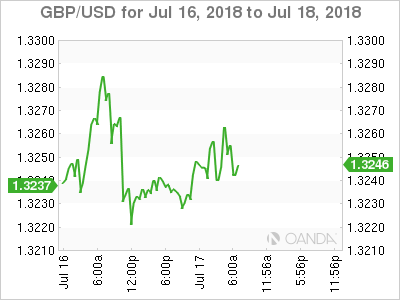

4. Cable drifts higher after jobs data

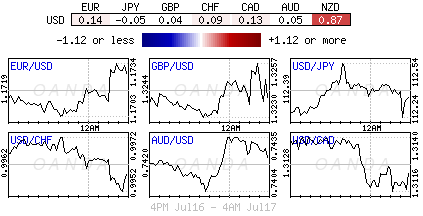

This morning’s U.K labor data in line with market expectations has sent the pound a tad higher. GBP/USD has rallied to £1.3263, up +0.2% on the day, while EUR/GBP has fallen to €0.8847.

Digging deeper, earnings growth ex-bonuses for the three months to June was +2.7% – it’s smaller than the +2.8% in the previous period. The unemployment rate also stayed flat at +4.2%, as expected.

Note: Market consensus does not expect this morning print to change expectations of an interest rate increase in August – currently; futures suggest there is a more than +70% chance of a rate rise in three weeks.

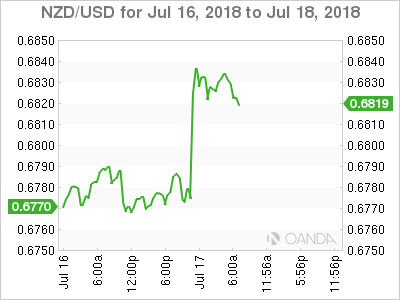

Elsewhere, down-under, NZD (NZ$0.6830) managed to rally aggressively overnight, the most in six-weeks following the RBNZ’s sectorial factor model inflation gauge surging to the highest level in seven years.

5. RBA flags rising trade war risks in meeting minutes

In its July minutes overnight, the Reserve Bank of Australia (RBA) said that downside risks to the global growth outlook increased in June amid rising tensions over trade between the worlds two largest economies.

Board members remain concerned that trade tensions extended beyond the U.S and China and “could escalate through non-tariff measures such as administrative delays,” adding that “escalation of trade tensions could harm global growth by undermining confidence and delaying investment decisions and could dampen international trade.”

They said that while heightened international trade worries had already weighed on global equity prices, as well as on some long-term government bonds and base metal prices, the bank still forecast Australia’s economic growth to “pick up to be a bit above +3% over 2018 and 2019”.