Key Highlights

- The Euro corrected lower this past week and tested the 1.1610 support against the US Dollar.

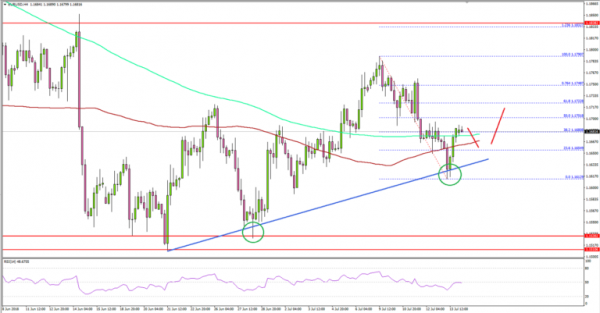

- There is a key bullish trend line formed with support at 1.1620 on the 4-hours chart of EUR/USD.

- On the upside, resistances are seen near 1.1720, 1.1740 and 1.1750.

- Today in the US, the Retail Sales figure for June 2018 will be released, which is forecasted to increase 0.6% (MoM).

EURUSD Technical Analysis

The Euro started a downward correction after trading as high as 1.1790 against the US Dollar. The EUR/USD pair declined and tested the 1.1610-20 support area where buyers appeared.

Looking at the 4-hours chart, the pair remains in a decent uptrend from the 1.1510 swing low. The recent dip from the 1.1790 high can be seen as a correction. The pair traded above the 23.6% Fib retracement level of the last decline from the 1.1790 high to 1.1610 low.

On the downside, there is a key bullish trend line formed with support at 1.1620 on the same chart. Therefore, as long as the pair is above the 1.1610-20 support area, it could continue to move higher.

On the upside, there is a key resistance near 1.1720, which coincides with the 61.8% Fib retracement level of the last decline from the 1.1790 high to 1.1610 low. A push above the 1.1720 resistance may perhaps clear the path for more gains towards the 1.1750 level.

Should the pair gain momentum above the 1.1790 high, the next resistance could be the target near the 1.236 Fib extension level of the last decline from the 1.1790 high to 1.1610 low at 1.1830.

On the flip side, if the pair breaks the trend line and the 1.1610 support, there may well be extended declines towards the 1.1560 support.

Economic Releases to Watch Today

- US Retail Sales June 2018 (MoM) – Forecast +0.6%, versus +0.8% previous.

- US Retail Sales ex Autos June 2018 (MoM) – Forecast +0.4%, versus +0.9% previous.

- US Retail Sales Control Group June 2018 – Forecast +0.4%, versus +0.5% previous.