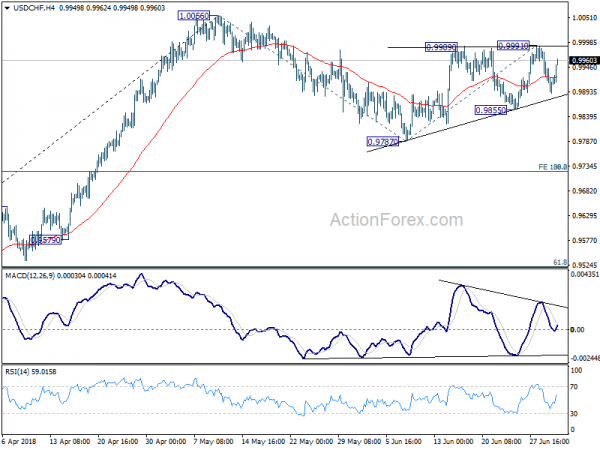

Daily Pivots: (S1) 0.9869; (P) 0.9928; (R1) 0.9963; More…

Intraday bias in USD/CHF remains neutral as it’s staying in range of 0.9855/9991. On the downside, below 0.9855 will resume the corrective decline from 1.0056, likely through 0.9787 support. But downside should be contained by 0.9722/4 cluster support (38.2% retracement of 0.9186 to 1.0056 at 0.9724, 100% projection of 1.0056 to 0.9787 from 0.9991 at 0.9722) to bring rebound. On the upside, firm break of 0.9991 will target a test on 1.0056 high.

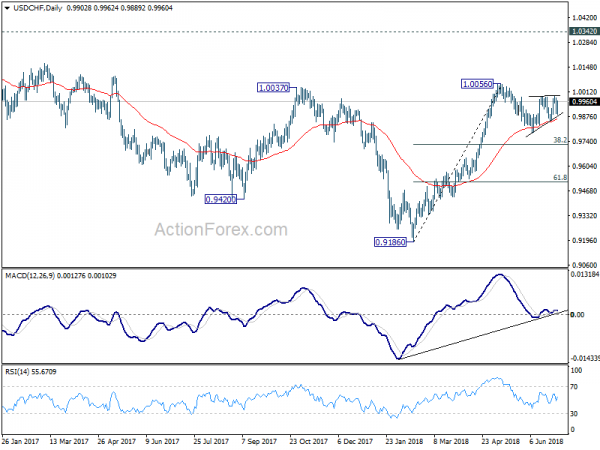

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. For now, further rise is expected as long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds. Above 1.0056 will target 1.0342 (2016 high). In that case, we’d be cautious on strong resistance from 1.0342 to limit upside. However, sustained break of 0.9724 will dampen this bullish view and would at least bring deeper fall to 61.8% retracement at 0.9518.