Here are the latest developments in global markets:

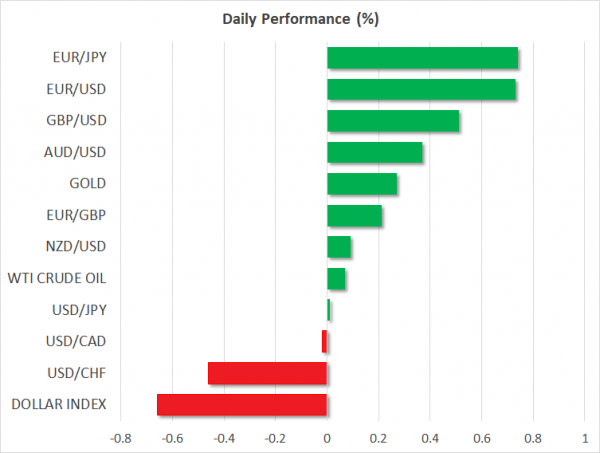

FOREX: The euro surged early on Friday following news that the 28 European Union leaders had agreed on migration overnight, driving euro/dollar towards an intraday high of 1.1666 (+0.68%). Also, in terms of economic data, on a yearly basis, the Eurozone preliminary CPI jumped to 2.0% in yearly terms as expected, from 1.9% previously. Euro/yen climbed by 0.68% to 128.66, posting a two-week high. Dollar/yen jumped to a two-week high as well of 110.78, adding 0.05% to its performance and is set to post the fourth consecutive green day, while the US dollar index dived by 0.63%. Sterling moved higher against the greenback (+0.59%) today, after an unexpected upward revision to UK’s Q1 GDP, which increased expectations of monetary policy tightening during the year. The antipodean currencies traded higher with aussie/dollar up by 0.48% to 0.7387, while kiwi/dollar was up by 0.013% after it recorded a one-year low of 0.6759.Dollar/loonie was last seen at 1.3225 (-0.14%).

STOCKS: European equities were in the green on Friday at 1030 GMT, with every single major blue-chip index being comfortably in positive territory as EU leaders reached a deal on migration. The UK’s FTSE 100, German DAX and French CAC 40 were up by 0.88%, 1.27% and 1.39% respectively after a sell-off earlier this week that saw them post multi-week lows. Even the Italian FTSE MIB, which underperformed, was up by a hefty 0.61%. The pan-European Stoxx 600 was up by 1.09% at 380.97 and at a relative distance to Wednesday’s more than two-month low. Meanwhile, the blue-chip Euro Stoxx 50 traded higher by 1.37% as well. Futures tracking the Dow and S&P 500 traded higher, pointing to a higher open on Wall Street.

COMMODITIES: In energy markets, West Texas Intermediate (WTI) crude oil corrected slightly lower, while London-based Brent crude oil moved significantly higher. WTI was down by 0.08% at $73.51 per barrel, however, it remains elevated near the three-and-a-half year high it reached on Thursday. Brent was up by 1.72% at $79.19 per barrel, creating a new one-month high. In precious metals, gold prices edged higher by 0.23% at $1,250.8 per ounce after touching a more than six-month low on Thursday.

Day ahead: US core PCE index awaited; EU summit eyed for Brexit clues

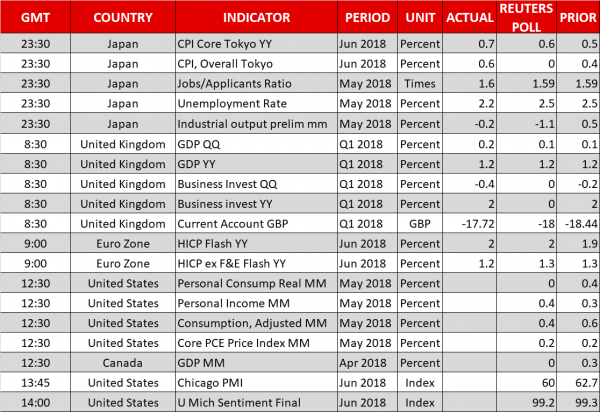

The most crucial releases left on Friday’s calendar are from the US. The core PCE price index, as well as personal consumption and income figures for May are all due for release at 1230 GMT. Beyond these figures, the conclusion of the EU summit in Brussels will be closely watched by sterling traders looking for fresh Brexit clues.

Kicking off with the data, the Fed’s preferred inflation measure – the core PCE price index – is expected to have risen by 1.9% in May on a yearly basis, from 1.8% previously. This would bring the rate within breathing distance of the Fed’s 2.0% inflation target. Meanwhile, expectations are mixed for the rest of the releases. In monthly terms, personal consumption is expected to have risen by 0.4% in May, a slower pace compared to April’s 0.6%, while personal income is forecast to have accelerated to 0.4%, from 0.3% previously.

Investors remain in doubt as to whether the Fed will deliver one, or two more rate increases this year. Whereas one more 25bps hike is already fully priced in, market pricing assigns just a 30% probability for a second one according to the Fed funds futures. A potential positive surprise in these data – especially in the core PCE and consumption figures – could make the prospect of two more rate increases more realistic, thereby bringing the dollar under renewed buying interest. The opposite holds true as well.

The Chicago PMI and final University of Michigan consumer sentiment index, both for June, are also due for release out of the US at 1345 and 1400 GMT respectively.

In Canada, monthly GDP figures will be in focus at 1230 GMT. The oil-exporting economy is expected to have recorded no growth in April, as opposed to the 0.3% seen in March.

In energy markets, the weekly Baker Hughes oil rig count is due at 1700 GMT.

Beyond economic data, the EU summit will wrap up later today, and any remarks on Brexit have the capacity to impact sterling. Following comments from EU chief Brexit negotiator Barnier earlier today that “big divergences” remain, it appears likely the EU leaders could express something along those lines too, highlighting the lack of progress on the Irish border issue.

As for the speakers, Donald Tusk and Jean-Claude Junker, the respective Presidents of the European Council and the European Commission, are expected to hold a press conference at 1130 GMT. Brexit and Eurozone reforms will be among the key topics.