Dollar trades mixed in early US session despite positive job data. Initial jobless claims dropped 12k to 234k in the week ended February 4, below expectation of 250k. Four week moving average dropped to 244.25, lowest since 1973. Continuing claims rose 15k to 2.08m in the week ended January 28. Also released in US session, Dollar index is hovering in tight range around 100.32 at the time of writing. Near term outlook is mixed. On the negative side, it’s still struggling below 55 day EMA (now at 100.65). On the positive side, daily MACD crossed above signal line. We’d maintain that there is prospect of a rebound after getting firm support from 100 handle.

Shinzo Abe to Meet Donald Trump

The meeting between US president Donald Trump and Japan prime minister Shinzo Abe in Washington on Friday will be closely watched by the markets. While there are news surrounding Trump’s accusation of Japan as currency manipulator and others, the key would be the development in trade relationships of the two countries. Trump dismissed the Trans Pacific Partnership in his very early days in office. And it’s known that Abe would like to secure a bilateral trade deal with the US.

BoJ Deputy Naksao: Persistent Powerful Monetary Easing needed

In Japan, BoJ Deputy Governor Hiroshi Naksao said that "it’s most important that the BOJ persistently pursue powerful monetary easing." And, he warned of risks of global uncertainties. Naksao noted that "momentum toward achieving our price target, while sustained, isn’t sufficient." And he emphasized that "there’s still a long way to go to achieve our target."Also, he defended accusation of currency manipulation and said that "the BOJ guides monetary policy solely for the purpose of achieving its inflation target at the earliest date possible. It does not target exchange rates."

Euro Weighed Down by France Uncertainties

Euro is mixed today but trades as the second weakest major currency for the week, next to Kiwi. The common currency is being weighed down by political uncertainties. In particular, in France, after a scandal of conservative candidate Francois Fillon, far-right candidate Marine Le Pen is seen as a serious contender for the presidential elections in April and May. According to latest poll, Le Pen could win the first election round on April 23, but without outright majority. That would put her in a runoff, likely with centralist Emmanuel Macron. Current poll suggests that Marcon would win. But in case of a Le Pen win, the possibility of a "Frexit" could surge sharply.

ECB Draghi to Meet Germany Merkel

ECB president Mario Draghi will meet German Chancellor Angela Merkel for a regular closed dollar meeting. Ahead of the meeting, German finance minister Wolfgang Schaeuble said that "it is an art to carefully prepare and plan an exit from an extraordinary monetary policy to prevent bigger distortions." And he preferred ECB to run a "prudent, carefully balanced monetary policy". But Draghi has been clear in his view that ECB won’t react to temporary spike in inflation. No press conference is scheduled after the meeting between Draghi and Merkel.

Kiwi trades lower after RBNZ

As expected, RBNZ left the OCR unchanged at 1.75%, following three rate cuts in 2016. The policy statement has changed to a more neutral tone from an accommodative one previously. Yet, the central bank’s rate hike forecasts stay at a slower pace than what the market has priced in. Policymakers acknowledged that economic growth has ‘increased as expected and is steadily drawing on spare resources’. The outlook remain s positive. It also acknowledged the return of headline CPI to the target band, and judged it would gradually move to the midpoint of the band. We expect the OCR would stay unchanged for the rest of the year. More in RBNZ’s Rate Hike Path Still Lags Market Expectations.

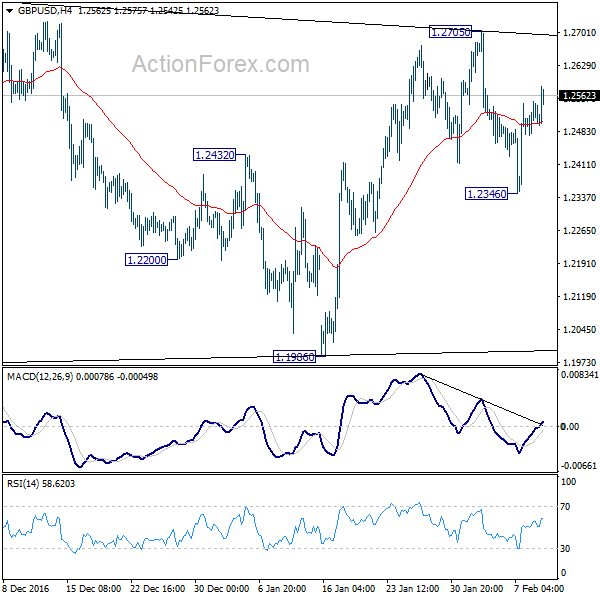

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2493; (P) 1.2521; (R1) 1.2568; More…

GBP/USD is staying in range of 1.2346/2705 and intraday bias remains neutral for the moment. Price actions from 1.1946 are viewed as a consolidation, no change in this view. In case of another rise, we’d expect upside to be limited by 1.2774 to bring larger down trend resumption. On the downside, below 1.2346 will revive the case that such consolidation is completed at 1.2705 already. In that case, intraday bias will turn back to the downside for retesting 1.1946 low.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 21:45 | NZD | Building Permits M/M Dec | -7.20% | -9.20% | -9.60% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jan | 4.10% | 4.00% | 4.00% | |

| 23:50 | JPY | Machine Orders M/M Dec | 6.70% | 3.10% | -5.10% | |

| 00:01 | GBP | RICS House Price Balance Jan | 25% | 22% | 24% | |

| 00:30 | AUD | NAB Business Confidence Q4 | 5 | 5 | 6 | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jan P | 3.50% | 4.40% | ||

| 06:45 | CHF | Unemployment Rate Jan | 3.30% | 3.30% | 3.30% | |

| 07:00 | EUR | German Trade Balance (EUR) Dec | 18.4B | 23.2B | 21.7B | 21.8B |

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.10% | 0.20% | 0.20% | |

| 13:30 | USD | Initial Jobless Claims (FEB 04) | 234K | 250k | 246k | |

| 15:30 | USD | Natural Gas Storage | -155B | -87B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box