Dollar trades mixed in early US session with notable weakness against Euro and Swiss Franc. The forex markets are relatively steady elsewhere, with Aussie and Loonie trading to recover while yen extends its pull back. US initial jobless claims rose 10k to 244k in the week ended April 15, slightly above expectation of 241k. Continuing claims dropped -49k to 1.98m in the week ended April 8, lowest since April 2000. Philly Fed survey dropped to 22.0 in April, down from 32.8, below expectation of 25.6. In other markets, US futures point to a mildly higher open and stocks could pare back some of yesterday’s steep loss. Gold is hovering around 1280 while crude oil is heading to test 50 psychological level.

Fed’s Beige Book: Modest to moderate expansion in all districts

Released yesterday, Fed’s latest Beige Book indicated that economic activity increased in each of the twelve Federal Reserve Districts between mid-February and the end of March. The the pace of expansion was "equally split between modest and moderate". On the labor market situation, the report noted that it "remained tight, and employers in most Districts had more difficulty filling low-skilled positions, although labor demand was stronger for higher skilled workers". It added that "modest wage increases broadened" with "bigger increases for workers with skills that are in short supply". A larger number of firms noted "higher turnover rates and more difficulty retaining workers". Yet, the wage pressure remained modest and has not yet significantly passed to selling prices. As the report suggested, "input prices generally increased at a modest rate and outpaced gains in selling prices, which rose only slightly".

UK PM May got parliament backing for snap election

UK Prime Minster Theresa May won backing from the parliament for the snap election on June 8. The bill was passed with overwhelming 522 to 13 votes. The Parliament will now formally be dissolved on May 3. May said that she won’t be doing TV debates as she believes in "campaigns where politicians actually go out and about and meet with voters. And she wants the election to focus on Brexit and gives her "the strongest possible hand" for negotiation with EU. She also noted that the election is "a choice between strong and stable leadership under the Conservatives or weak and unstable coalition of chaos led by Jeremy Corbyn."

ECB officials sound cautious on stimulus exit

ECB governing council member Benoit Coeure said yesterday that policy makers are "very, very serious about the forward guidance". Coeure referred to the communicates that ECB will keep buying assets "until December or later if necessary, that rates will remain low". Coeure sees no reason to change the sequence. Another governing council member Francois Villeroy de Galhau said that the "current monetary policy stance remains fully appropriate based on current information." ECB chief economist Peter Praet said that "risks are still tilted to the downside" in the medium term. Released from Eurozone, German PPI rose 0.0%, 3.1% yoy in March.

Australia business confidence unchanged

Australia NAB quarterly business confidence was unchanged at 6 in Q1. NAB chief economist Alan Oster noted that employment expectations hit multi-year highs in short and medium term. And the set of data "points to a tighter labour market than the ABS unemployment rate is currently suggesting." Also, capex plans reached highest level since 2011. Thus, with lack of inflation pressure, RBA would stand pat for an "extended period".

New Zealand CPI jumped

New Zealand CPI rose 1.0% qoq in Q1, up from prior quarter’s 0.4% qoq, and beat expectation of 0.8% qoq. Kiwi jumped briefly on talk that RBNZ is falling behind the curve. And the central bank could be forced to raise interest rates. Overnight index swaps are pricing in 80% chance of a rate hike within the coming 12 months.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0694; (P) 1.0715 (R1) 1.0732; More….

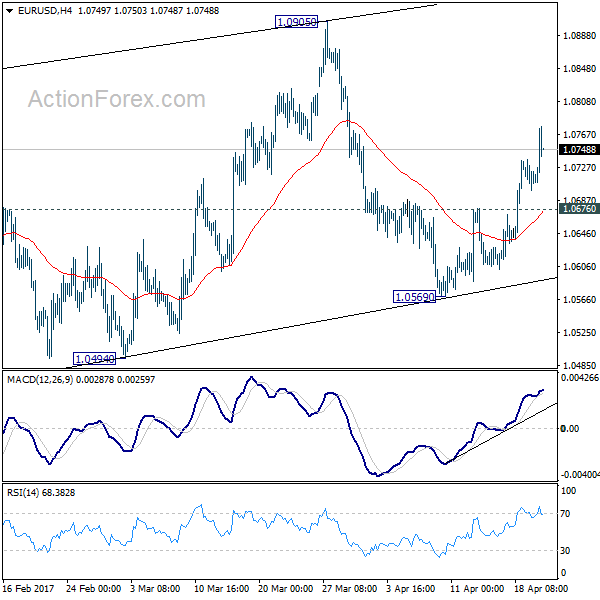

EUR/USD’s rise from 1.0569 continues today and reaches as high as 1.0777 so far. Intraday bias remains on the upside for 1.0905 resistance and above. Nonetheless, choppy rise from 1.0339 is still seen as a correction. Hence, we’ll pay attention to topping signal above 1.0905 again, as we’d expect larger down trend to resume later. On the downside, break of 1.0676 minor support will turn intraday bias back to the downside for 1.0569 instead.

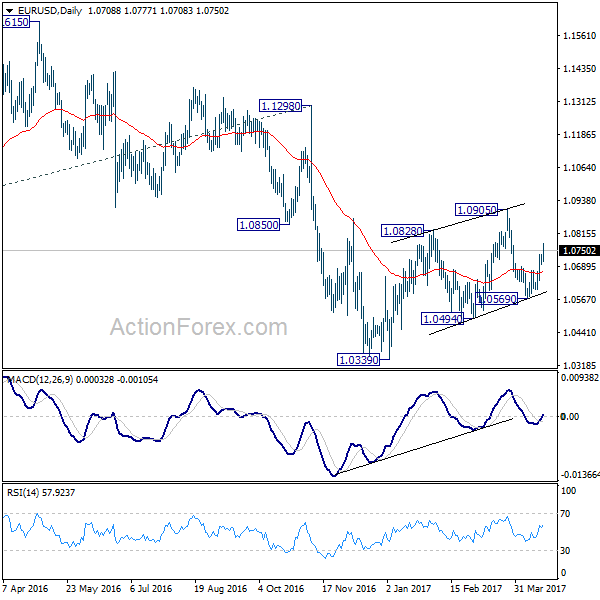

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. this would also be supported by sustained trading above 55 week EMA.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q1 | 1.00% | 0.80% | 0.40% | |

| 23:50 | JPY | Trade Balance (JPY) Mar | 0.17T | 0.61T | 0.68T | 0.61T |

| 01:30 | AUD | NAB Business Confidence Q1 | 6 | 5 | 6 | |

| 06:00 | EUR | German PPI M/M Mar | 0.00% | 0.20% | 0.20% | |

| 06:00 | EUR | German PPI Y/Y Mar | 3.10% | 3.10% | ||

| 12:30 | USD | Initial Jobless Claims (APR 15) | 244K | 241K | 234K | |

| 12:30 | USD | Philly Fed Manufacturing Index Apr | 22 | 25.6 | 32.8 | |

| 14:00 | EUR | Eurozone Consumer Confidence Apr A | -5 | -5 | ||

| 14:00 | USD | Leading Indicators Mar | 0.20% | 0.60% | ||

| 14:30 | USD | Natural Gas Storage | 10B |