Sterling trades as the strongest one today as markets were surprised by the voting on BoE Bank Rate. With the highly respected Chief Economist Andrew Haldane voted for a hike, the chance of an August move in interest rate is heavily boosted. The statement also showed a lot of confidence among policy makers on the growth and inflation outlook. Meanwhile, Swiss Franc is also firm after SNB gave the markets no surprise with the monetary policy decision and the statement. Though, the Franc lags behind Aussie, which is trading as the second strongest. On the other hand, Euro is broadly lower today as the weakest, follow by Yen.

Technically, however, the outlook remains largely unchanged despite today’s movements. Firstly, while GBP/USD’s rebound is strong, it’s kept well below 1.3471 key near term resistance. Bearish outlook remains and GBP/USD could be having just more consolidations first. EUR/GBP is still bounded in range of 0.8693/8844 and stays neutral. GBP/JPY is also held below 146.46 minor resistance, which favors more downside ahead. Euro, dipped to 1.1507 but recovered and it’s holding on to 1.1509 support so far. There is no confirmation of breakout yet.

From the US, initial jobless claims dropped to 218k in the week ended June 16. Philly Fed manufacturing index dropped to 19.9 in June. Canada wholesale sales rose 0.1% mom in April.

Sterling surges as BoE chief economist Haldane joined hawks to vote for rate hike

Sterling surges BoE kept bank rate unchanged 0.50% with 6-3 vote. The usual suspects Ian McCafferty and Michael Saunders voted for a hike to 0.75%. And to many’s surprise, chief economist Andrew Haldane voted for a hike too. His vote carries much significance.

On growth, BoE noted the judgement that the dip in Q1 was temporary “appears broadly on track”. It pointed to the rebound in household consumption and sentiments as evidence while “employment growth has remained solid”. Despite decline in manufacturing output in April, surveys of business activity have been stable. And overall, the data “point to growth in the second quarter in line with the Committee’s May projections.

On inflation, BoE expects CPI to “pick up by slightly more than projected” in the near term. That reflects ” higher dollar oil prices and a weaker sterling exchange rate.” And, indicators of wage growth also picked up with labor markets remains tight. “Domestic cost pressures will continue to firm gradually, as expected.”

On forward guidance, BoE expects to maintain the size of assets purchased at GBP 435B and use the Bank Rate as “primary instrument” for momentary policy for now. And BoE will NOT reduce the size of the assets until Bank Rate reaches around 1.50%, lowered from prior guidance of around 2.00%.

Also from UK, public sector net borrowing dropped to GBP 3.4B in May.

SNB stands pat, raised 2018 inflation forecasts, but lowered 2020’s

SNB left monetary policy unchanged as widely expected. Sight deposit rate is held at -0.75%. Three-month Libor target range is kept at -1.25% to -0.25%. SNB also pledge to stand by for intervention and “remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration”.

2018 inflation forecast was raised to 0.9%, up from March projection of 0.6%. That’s due to a “marked rise in the price of oil”. 2019 inflation forecast was kept unchanged at 0.9%. Though, from mid-2019, the new condition forecast is lowered due to “muted outlook in the euro area”. For 2020, inflation forecast was lowered to 1.6%, down from March projection of 1.9%.

All the inflation forecasts were based on assumption the three month Libor remains at -0.75% over the entire forecast horizon.

On global growth, SNB expected economy to continue to grow above its potential. But risks are “more to the downside” due to “political developments in certain countries as well as potential international tensions and protectionist tendencies.” Swiss GDP is projected to growth at around 2% in 208, unchanged. And unemployment is expected to fall further.

Also from Swiss, trade surplus widened to CHF 2.76B in May.

EU Malmstrom urges New Zealand to lead by example together on multilateral trade

EU Trade Commissioner Cecilia Malmstrom launched free trade negotiation with New Zealand in Wellington today. Trade negotiation teams from both sides would start the first round of talks in Brussels over July 16-20. Malmstrom said in a press conference after meeting New Zealand trade minister David Parker that “today is an important milestone in EU- New Zealand relations. Together, we can conclude a win-win agreement that offers benefits to business and citizens alike.”

She also emphasized that “This agreement is an excellent opportunity to set ambitious common rules and shape globalization, making trade easier while safeguarding sustainable development. We can lead by example.”

Malmstrom also hailed New Zealand as “a friend, an ally”. And she urged that “together we stand up for common values … of sustainable trade, open trade, transparent trade, and trade that is done in compliance with international rules in the multilateral system.”

The New Zealand government recently launched its “Trade for All Agenda“, calling for a “progressive and inclusive” approach to negotiating trade deals. Parker said “we can not only do good for ourselves in this trade agreement but we can actually set out rules for how trading agreements should look for the betterment of the world.”

Parker also hailed that Malmstrom has asked negotiators to work through the complicated areas early, so as not to cause delays in the end. He said “I think that demonstrates a willingness on the part of the European side of the negotiation, which we share, to bring this to a conclusion as soon as we can.”

New Zealand GDP growth slowed to 0.5% qoq in Q1

New Zealand GDP grew 0.5% qoq in the March quarter, slowed from 0.6% qoq in the prior quarter and met expectation. Over the year, GDP grew 2.7% ended March 2018. Per capita GDP was unchanged, down from 0.1% qoq rise in the prior quarter. Services industries grew 0.6%, notably slowed from prior 1.1%. Good-producing industries were flat as jump in manufacturing was offset by fall in constructions. Primary industries rebounded by growing 0.6%, up from prior quarter’s -2.6%.

Chinese Vice Premier to meet European Commission Vice President Katainen next week on trade

Chinese Vice Premier Liu He will be meeting with European Commission Vice President Jyrki Katainen in Beijing on June 25. That’s the seventh China-EU high level economic and trade summit since 2007, when the mechanism was established.

Spokesman of the Ministry of Commerce said in a regular briefing that the meeting is an important platform for for communications and coordinations of economic and trade policies. And it’s an important time when “trade and economic cooperation faces new historical opportunities.”

Issues to be discussed will include ” global economic governance, trade and investment, innovation-driven development, and interconnection that are of common concern to both sides”. And, it’s a “positive signal between China and the EU to oppose unilateralism and protectionism and support the multilateral trading system.”

GBP/USD Mid-Day Outlook

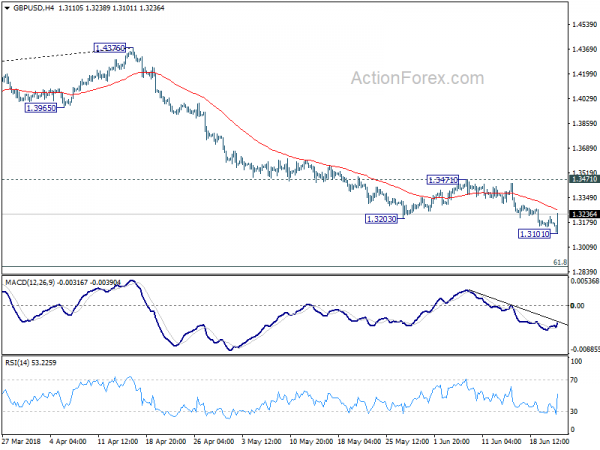

Daily Pivots: (S1) 1.3142; (P) 1.3179; (R1) 1.3211; More…

GBP/USD rebounds strongly after edging lower to 1.3101. As a temporary low is formed, intraday bias is turned neutral for consolidation. But still, near term outlook will remain bearish as long as 1.3471 resistance holds. And larger decline is expected to continue. On the downside, break of 1.3101 will resume the fall from 1.4376 for 61.8% retracement of 1.1946 to 1.4376 at 1.2875 next.

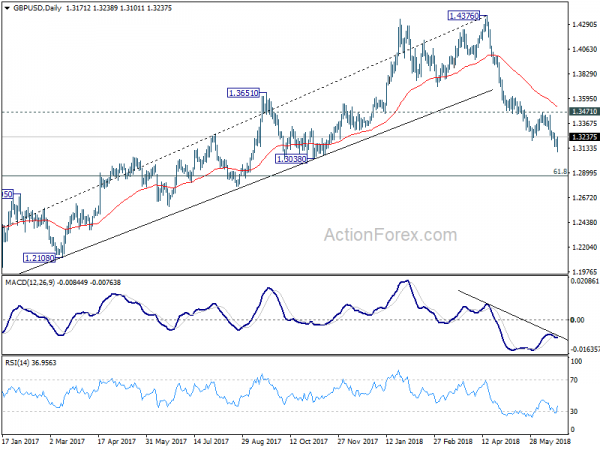

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4177). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 55 day EMA (now at 1.3527) holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q1 | 0.50% | 0.50% | 0.60% | |

| 06:00 | CHF | Trade Balance (CHF) May | 2.76B | 1.89B | 2.29B | 2.24B |

| 07:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | -0.75% | |

| 07:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | -1.25% | |

| 07:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | -0.25% | |

| 08:30 | GBP | Public Sector Net Borrowing May | 3.4B | 5.1B | 6.2B | 5.3B |

| 11:00 | GBP | BoE Official Bank Rate | 0.50% | 0.50% | 0.50% | |

| 11:00 | GBP | BoE Asset Purchase Target Jun | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 3–0–6 | 2–0–7 | 2–0–7 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:30 | CAD | Wholesale Sales M/M Apr | 0.10% | 0.50% | 1.10% | 1.40% |

| 12:30 | USD | Initial Jobless Claims (JUN 16) | 218K | 220K | 218K | 221K |

| 12:30 | USD | Philly Fed Manufacturing Index Jun | 19.9 | 25 | 34.4 | |

| 13:00 | USD | House Price Index M/M Apr | 0.30% | 0.10% | ||

| 14:00 | USD | Leading Index May | 0.40% | 0.40% | ||

| 14:00 | EUR | Eurozone Consumer Confidence (JUN A) | 0 | 0 | ||

| 14:30 | USD | Natural Gas Storage | 96B |