‘We still think the dollar is going to strengthen over time based on the outlook for US monetary policy… but for now, with markets not heavily focused on monetary policy, it could explain this consolidation (for the greenback).’ – Wells Fargo (based on Business Recorder)

Pair’s Outlook

The Greenback was unable to outperform the Japanese currency yesterday, which resulted in a failure to preserve the descending channel pattern. Nevertheless, the Buck is not ready to give up and is likely to take another shot at pushing higher in order to settle above the channel’s support line. The 200-day SMA is unlikely to provide resistance at this point, but the monthly S1 at 108.17 is the level to focus on, as it prevented the US Dollar from edging higher four times now. Meanwhile, technical indicators are unable to confirm the possibility of the positive outcome, but signals are no longer bearish.

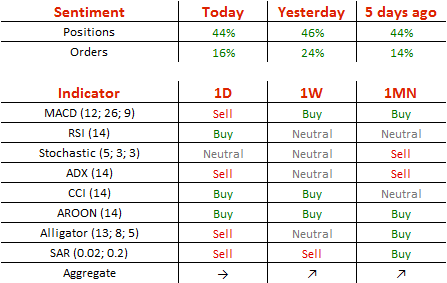

Traders’ Sentiment

Market sentiment remains strongly bullish, as 72% of all open positions are long (previously 73%). The number of orders to acquire the Buck edged down from 62 to 58%.