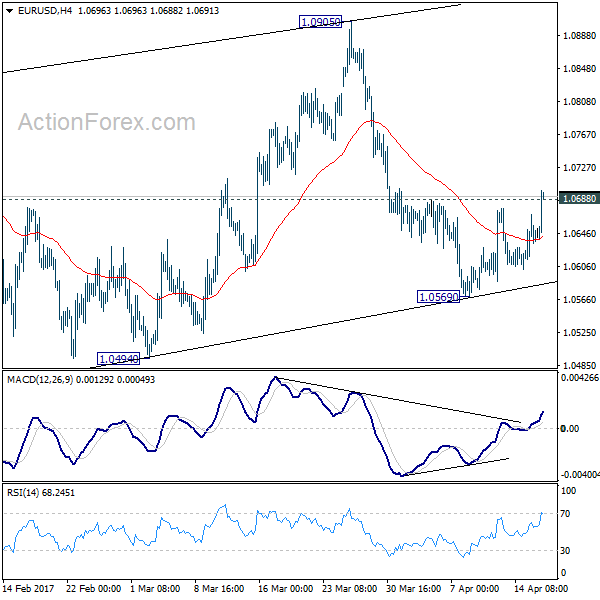

Daily Pivots: (S1) 1.0605; (P) 1.0638 (R1) 1.0674; More….

EUR/USD’s rebound form 1.0569 resumed and broke 1.0668 resistance. The development dampened our immediate bearish view. Fall from 1.0905 is completed and intraday bias is back on the upside for 1.0905 resistance. Nonetheless, price actions from 1.0339 are still viewed as a correction and thus, we’ll look for topping signal above 1.0905 to complete the correction. On the downside, break of 1.0569 will revive that case that such correction from 1.0339 is completed and turn bias to the downside for 1.0494 support.

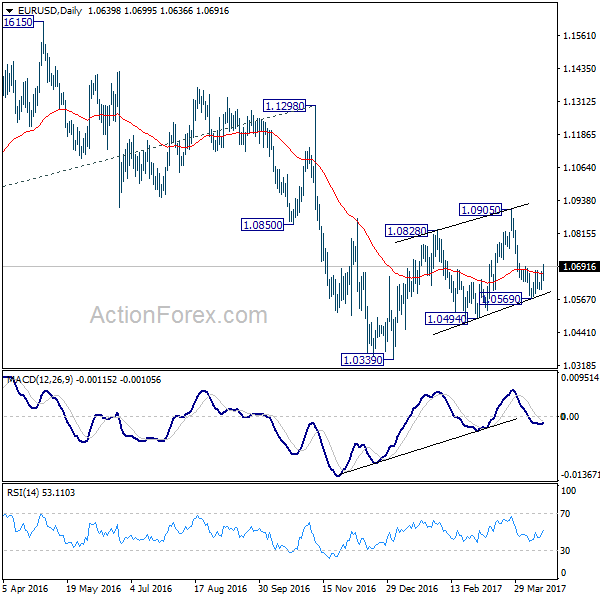

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. this would also be supported by sustained trading above 55 week EMA.