Yen is picking up some strength in Asian session today while commodity currencies are generally lower. Pull back in US treasury yield is a factor that’s support the Yen. 10 year yield hit as high as 2.992 over night but reversed to close at 2.933, down -0.042. That development dragged down USD/JPY, which is now back pressing 109.46 minor support. There isn’t much new developments in the markets as eyes are on the G6+1 summit in Canada today and tomorrow. Confrontations are expected to continue between the US and others on trade issue. But traders could find themselves disappointed as US President Donald Trump has decided to leave the summit earlier to prepare for the meeting with North Korean Kim Jong-un three days after.

French Macron: We don’t mind being six, if needs be

French President Emmanuel Macron urged to remain polite and productive in the G6+1 summit in Canada. But he also warned that “no leader is forever”. Macron added that “maybe the American president doesn’t care about being isolated today, but we don’t mind being six, if needs be.” And, “because these six represent values, represent an economic market, and more than anything, represent a real force at the international level today.”

Combative Trump to leave the G6+1 ring early

The White House announced yesterday that Trump will leave the G6+1 summit in Canada earlier than anticipated, right after Saturday’s morning session, on June 9. Then he will fly straight to Singapore for the highly anticipated Kim-Trump summit on June 12. G7 Sherpa and Deputy Assistant to the President for International Economic Affairs Everett Eissenstat will stay for the remaining session.

CBI expects BoE hikes in Q3 2018, Q1 2019 and Q4 2019

The Confederation of British Industry projects UK growth to lag well behind peers in 2018 and 2019. UK real GDP growth is forecast to be at 1.4% in 2018 and 1.3% in 2019 only. Eurozone growth is forecast to be at 2.2% in 2019 and 1.7% in 2019. US growth is forecast to be at 2.% in 2018 and 2.3% in 2019.

Though, UK would still be better than Japan at 1.1% growth in both 2018 and 2019. India is projected to stay strong with 7.3% growth in 2018 and 7.1% in 2019. China’s growth is expected to slow notably to 6.3% in 2018 and 5.8% in 2019.

On monetary policy, CBI expects 25bps BoE hike in Q3 2018, Q1 2019 and Q4 2019. Inflation is projected to slow to 2.1% at the end of 2019.

CBI Chief Economist Rain Newton-Smith said that there is no disguising that UK is in “slow lane” for growth. And, “productivity weakness is a structural challenge for the UK economy and a drag on living standards.” She also urged firms to work with the Government to “nurture a pro-enterprise environment to drive growth and create wealth.” Also, “business and government must work together to drive competitiveness at home so firms can make the most of opportunities overseas” after Brexit.

China YTD trade surplus with EU narrowed to USD 45.2B, with US widened to USD 104.9B

China’s trade surplus narrowed to USD 24.9B in May, below expectation of USD 32.5B. Exports rose 12.6% yoy to USD 212.8B while imports rose 26.0% yoy to USD 187.9B. in CNY terms, Exports rose 3.2% to CNY 1341B while imports rose 15.6% to CNY 1185B. Trade surplus narrowed to CNY 157B, below expectation of CNY 192B.

From January to May, exports to US rose 13.6% yoy to USD 175.17B while imports from the US grew 11.9% yoy to USD 70.32B. Trade surplus to the US was at USD 104.85B, widened from 2017 same period of USD 92.9B. Total trade with the US grew 13.1% to USD 245.50B.

For the same period, exports to EU rose 12.0% yoy to USD 155.39B while imports from EU rose 19.9% yoy to USD 110.21B. Trade surplus to EU was at USD 45.18B, narrowed from 2017 same period of USD 47.9B. Total trade with EU rose 15.1% yoy to USD 265.60B.

Canada job data to watch

On the data front, Japan Q1 GDP was finalized at -0.2% qoq, unrevised. GDP deflator was finalized at 0.5% yoy. Current account surplus widened to JPY 1.89T in April. German trade balance and industrial production will be featured in European session. But the main focus will be on Canada job data. The employment market is expected to grow 19.1k in May while unemployment would be unchanged at 5.8%. Canada will also release housing starts.

USD/JPY Daily Outlook

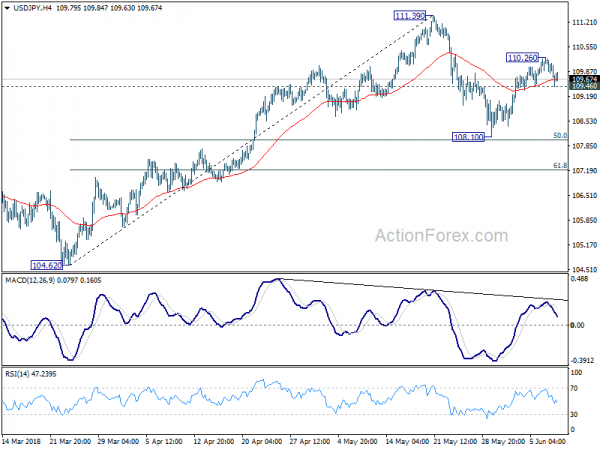

Daily Pivots: (S1) 109.39; (P) 109.79; (R1) 110.10; More…

Intraday bias in USD/JPY is neutral for the moment with focus on 109.46 minor support. Break there will suggest that rebound from 108.10 has completed at 110.26 already. And intraday bias will be turned back to the downside for 108.10, or further to 61.8% retracement of 104.62 to 111.39 at 107.20. Though, break of 110.26 will resume the rebound to 111.39 resistance next.

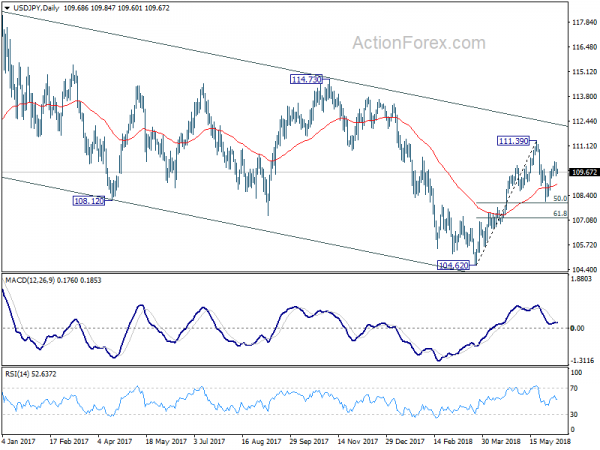

In the bigger picture, at this point, we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Apr | 1.89T | 2.09T | 1.77T | |

| 23:50 | JPY | GDP Q/Q Q1 F | -0.20% | -0.20% | -0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 0.50% | 0.50% | 0.50% | |

| 03:15 | CNY | Trade Balance (CNY) May | 157B | 192B | 183B | |

| 03:23 | CNY | Trade Balance (USD) May | 24.9B | 32.5B | 28.8B | |

| 06:00 | EUR | German Trade Balance (EUR) Apr | 20.3B | 22.0B | ||

| 06:00 | EUR | German Industrial Production M/M Apr | 0.40% | 1.00% | ||

| 12:15 | CAD | Housing Starts May | 217K | 215K | ||

| 12:30 | CAD | Net Change in Employment May | 19.1K | -1.1K | ||

| 12:30 | CAD | Unemployment Rate May | 5.80% | 5.80% | ||

| 14:00 | USD | Wholesale Inventories M/M Apr F | 0.00% | 0.00% |