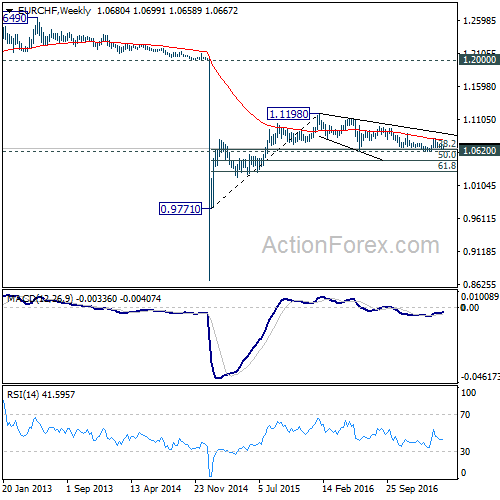

EUR/CHF’s fall from 1.0823 extended last week by taking out 1.0668 support and reached as low as 1.0658. The near term bearish outlook remains unchanged. That is, rebound from 1.0629 has completed at 1.0823. And, the larger decline from 1.1198 is likely resuming.

Initial bias in EUR/CHF remains on the downside this week for 1.0620/29 key support zone. Decisive break there will confirm resumption of whole fall from 1.1198. In that case, EUR/CHF should target next long term fibonacci level at 1.0485. On the upside, break of 1.0699 minor resistance will turn intraday bias neutral first. We’ll assess the outlook later in that case.

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Current development suggests that it’s not completed yet. Sustained trading below 38.2% retracement of 0.9771 to 1.1198 at 1.0653 will target 50% retracement at 1.0485. In any case, break of 1.0823 resistance is needed to be the first indication of reversal. Otherwise, deeper fall is still expected even in case of recovery.