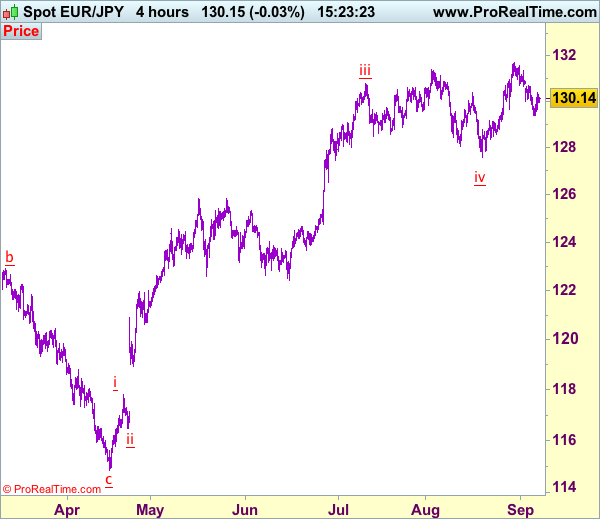

EUR/JPY – 130.15

Original strategy:

Sold at 130.25, Target: 128.25, Stop: 130.85

Position: – Short at 130.25

Target: – 128.25

Stop: – 130.85

New strategy :

Exit short entered at 130.25

Position: – Short at 130.25

Target: –

Stop:-

As the single currency found buying interest at 129.63 and has rebounded again, suggesting further consolidation above this week’s low at 129.37 would be seen and upside risk remains for recovery to 130.50-60, however, if our view that a temporary top formed at 131.71 is correct, upside would be limited to 131.35 and price should falter below 131.71, bring another leg of corrective fall later.

In view of this, would be prudent to exit short entered at 130.25 and look to sell euro again on further subsequent rebound. Below said support at 129.63 would bring retest of this week’s low at 129.37 but break there is needed to revive bearishness and extend the corrective decline from 131.71 top for retracement of recent upmove to 129.10-15, then towards 128.70-75, however, support at 128.49 should remain intact. .

Our latest preferred count is that wave (ii) is ABC-X-ABC which ended at 123.33 and wave (iii) is unfolding with wave iii ended at 100.77, followed by wave iv at 111.57 and wave v as well as the wave (iii) has ended at 97.04, followed by wave (iv) at 111.43 and wave (v) has ended at 94.12 which is also the end of the larger degree v, this also implied the major wave (C) has also ended there, hence major correction has commenced from there with (A) leg unfolding in its lower degree wave c which has possibly ended at 145.69. Under this count, A-B-C wave (B) has commenced with A leg ended at 136.23, wave B at 143.79 and wave C has possibly ended at 149.79.

Our larger degree count is that the decline from 139.26 is wave (C) and is sub-divided into a diagonal triangle i-ii-iii-iv-v with wave i – 105.44, wave ii- 123.33, wave iii – 97.03, wave iv – 111.43, followed by the final wave v as well as the end of wave (C) at 94.12, this also mark the bottom of larger degree wave B. Under this count, major rise in wave C has commenced as an impulsive wave with minor wave III ended at 145.69, wave V is still in progress for further gain to 150.00. Having said that, this so-called wave V could well be the first leg of larger degree 5-waver wave C and this wave C should bring at least a retest of wave A top at 169.97 (July 2008).