Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 5 Sep 2016

• Trend bias: Down

Daily

• Last Candlesticks pattern: Long black candlestick

• Time of formation: 24 Jun 2016

• Trend bias: Down

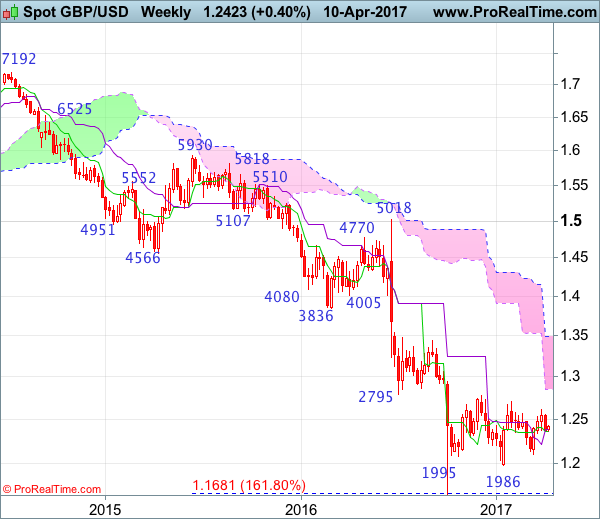

GBP/USD – 1.2409

The British pound met renewed selling interest just above 1.2500 level and has slipped again, suggesting near term downside risk remains for the erratic fall from 1.2616 to bring at least a retracement of recent upmove to previous support at 1.2335, once this level is penetrated, this would signal the rise from 1.2109 has ended, then weakness to 1.2240-50 would follow but downside should be limited to 1.2190-00 and bring rebound later this month.

On the upside, whilst initial recovery to 1.2450-60 cannot e ruled out, reckon 1.2480 would limit upside and resistance at 1.2506 should hold from here, bring another decline. A daily close above said resistance at 1.2506 would bring risk rebound to 1.2555-60 but only a break above there would signal the retreat from 1.2616 has ended and revive bullishness for retest of this level first, break there would extend the rise from 1.2109 to 1.2650, however, as broad outlook remains consolidative, reckon upside would be limited and price should falter well below indicated previous resistance at 1.2706, bring retreat later. In the event cable is able to penetrate resistance at 1.2706, this would retain bullishness and extend the erratic rise from 1.1986 low towards another previous resistance at 1.2775 first.

Recommendation: Stand aside for this week.

On the weekly chart, although last week’s decline from 1.2506 formed a black candlestick and further consolidation below resistance at 1.2616 would be seen with initial downside bias for weakness to 1.2335 support, break there is needed to add credence to our view that rebound from 1.2109 has ended, bring further fall to 1.2240-50, then 1.2200. Looking ahead, a drop below 1.2109 support is needed to retain bearishness and suggest medium term downtrend has resumed for weakness towards recent low at 1.1986.

On the upside, expect recovery to be limited to 1.2480-85 and resistance at 1.2506 should hold, bring another decline. Above said resistance 1.2506 would bring test of 1.2559, however, break there is needed to signal the retreat from 1.2616 has ended, bring retest of this level first. Once this resistance is penetrated, this would revive previous near term bullish view that another leg of corrective rise from 1.1986 low is underway and extend gain to 1.2706 resistance but only break there would provide confirmation, bring retracement of early downtrend for test of previous resistance at 1.2775 and later 1.2850-60 but price should falter well below psychological resistance at 1.3000.