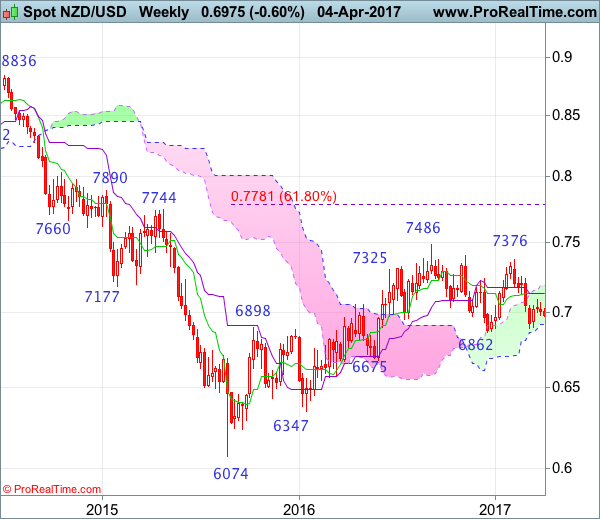

Weekly

- Last Candlesticks pattern: Shooting star

- Time of formation: 5 Sep 2016

- Trend bias: Down

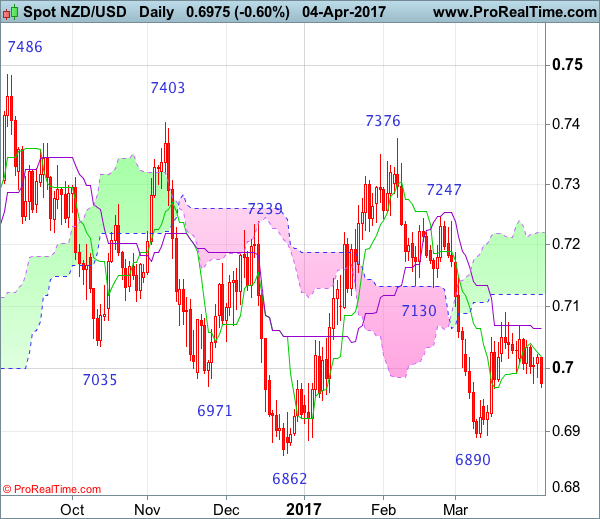

Daily

- Last Candlesticks pattern: Hammer

- Time of formation: 14 Mar 2017

- Trend bias: Near term up

NZD/USD – 0.6974

Although kiwi met resistance at 0.7090 and has retreated since latter part of March and marginal weakness from here cannot be ruled out, as long as support at 0.6890 holds, further consolidation would be seen with mild upside bias for another rebound, above 0.7045-50 would bring test of said resistance at 0.7090 but break there is needed to signal another leg of rebound from 0.6890 low is underway for at least a retracement of recent decline from 0.7376 to the lower Kumo (now at 0.7119), however, break of previous support at 0.7130 is needed to retain bullishness and encourage for further subsequent rise to 0.7185-90 but resistance at 0.7247 should remain intact.

On the downside, whilst marginal weakness from here cannot be ruled out, reckon downside would be limited to 0.6930-40 and said support at 0.6890 should remain intact, bring another rebound later. Only a break below 0.6890 would revive bearishness and extend the fall from 0.7376 top to 0.6862, then towards 0.6775-80 (50% Fibonacci retracement of 0.6074-0.7486) but price should stay well above previous chart support at 0.6675.

Recommendation: Hold long at 0.6980 for 0.7180 with stop below 0.6880

On the weekly chart, as kiwi has retreated after meeting resistance at 0.7090 last month and initial downside risk is seen, reckon indicated support at 0.6890 would hold and bring another rebound later, above 0.7045-50 would bring test of said resistance at 0.7090, break there would suggest low is possibly formed but a weekly close above Kijun-Sen (now at 0.7133) is needed to add credence to this view and encourage for further gain towards resistance at 0.7247. Having said that, as broad outlook remains consolidative, reckon upside would be limited to 0.7300-10 and price should falter below said resistance at 0.7376, bring retreat later.

On the downside, expect pullback to be limited to 0.6930-40 and bring another rebound. Only below said support at 0.6890 would abort and bring test of previous support at 0.6862, however, a breach of latter level is needed to retain bearishness and extend the erratic decline from 0.7486 top to 0.6780 (50% Fibonacci retracement of 0.6074-0.7486) and later towards previous chart support at 0.6675 which is likely to hold from here.