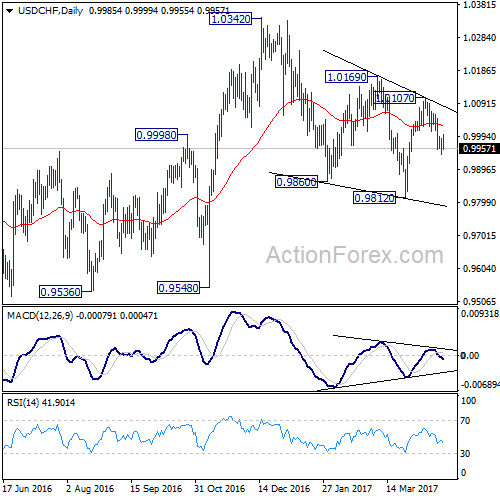

USD/CHF’s decline last week argues that rebound from 0.9812 has completed at 1.0107 already. And more importantly, the corrective fall from 1.0342 could be in progress and has started another falling leg. Hence, deeper decline is mildly in favor in near term before larger rise resumes.

Initial bias in USD/CHF remains neutral this week for consolidations above 0.9940 temporary low. Another fall is expected as long as 1.0008 minor resistance holds. Below 0.9940 will turn bias to the downside for 0.9812 and below. Fall from 1.0342 is seen as a correction. Hence, we’ll look for bottoming signal below 0.9812. Meanwhile, on the upside, above 1.0008 minor resistance will turn bias back to the upside for 1.0107 resistance instead.

In the bigger picture, we’re still maintaining that firm break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the cross. However, the corrective nature of the fall from 1.0342 is starting to give the medium term outlook a bullish favor. Hence, in stead of looking for topping signal around 1.0342, we’d now pay closer attention to upside acceleration as USD/CHF approaches this level again.

The long term outlook in USD/CHF stays a bit mixed for the moment. But in case of another medium term fall, we’d expect strong support from 0.9443/9548 support zone. Meanwhile, firm break of 1.0342 will target 38.2% retracement of 1.8305 to 0.7065 at 1.1359.