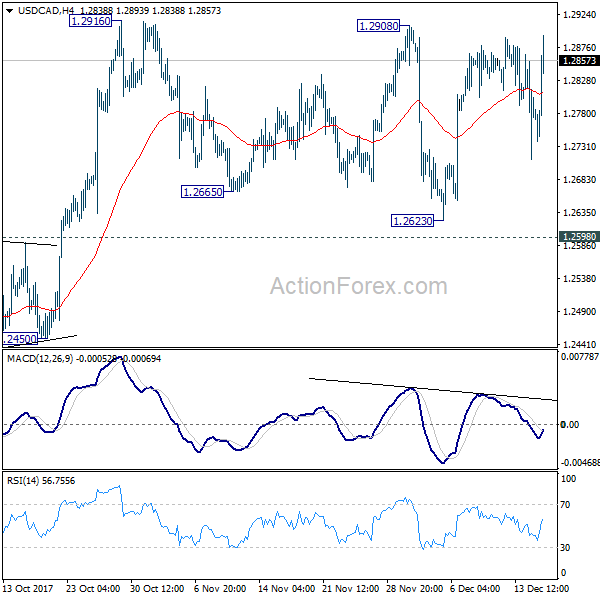

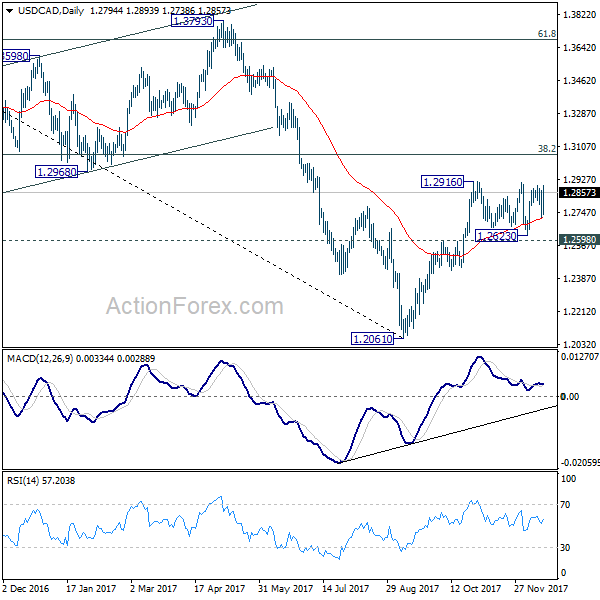

USD/CAD’s sideway consolidation continued last week and outlook is unchanged. Initial bias remains neutral this week first. With 1.2598 resistance turned support intact, outlook remains bullish and further rally is expected. On the upside, break of 1.2916 will resume the rise from 1.2061 and target 1.3065 medium term fibonacci level next. However, sustained break of 1.2598 will argue that rebound from 1.2061 has completed after hitting 55 week EMA (now at 1.2885). Near term outlook will be turned bearish in this case.

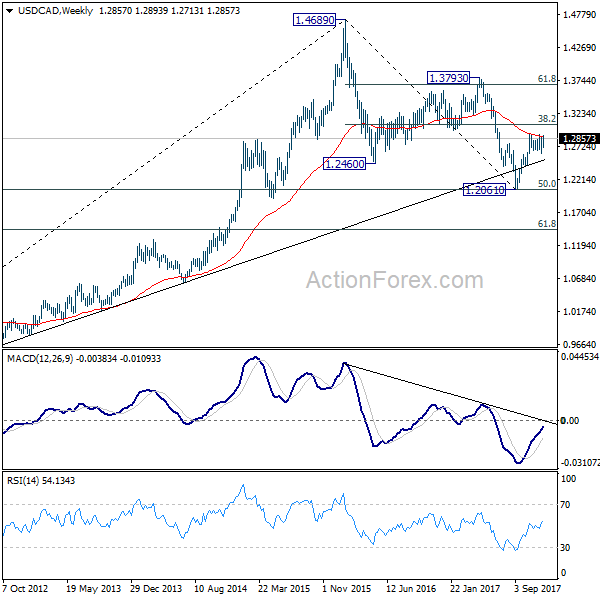

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

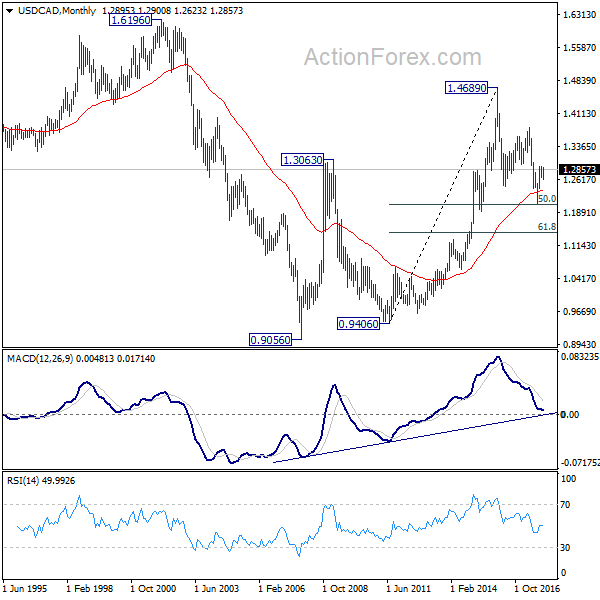

In the longer term picture, current development argues that correction from 1.4689 has completed with three waves down to 1.2061 already. And larger up trend from 0.9056 (2007 low) is still in progress. Firm break of 1.3793 resistance should now indicate up trend resumption through 1.4689 high.