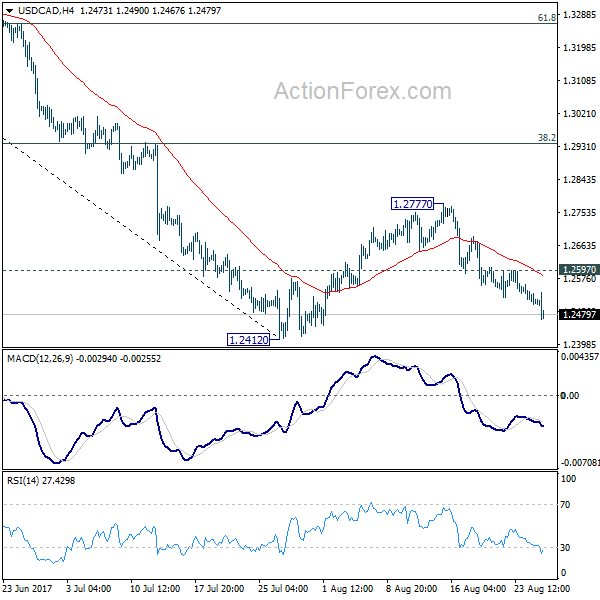

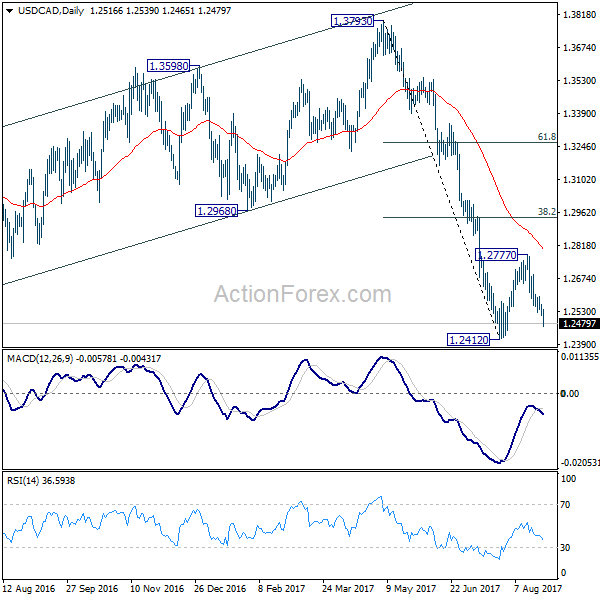

USD/CAD’s decline from 1.2777 extended lower last week. The development affirmed the case that correction from 1.2412 has already completed and larger fall is resuming. Initial bias stays on the downside this week for 1.2412 first. Decisive break there will target next long term fibonacci level at 1.2048. On the upside, above 1.2597 minor resistance will extend the correction from 1.2412 with another rise. But we’d expect upside to be limited by 38.2% retracement of 1.3793 to 1.2412 at 1.2940 to bring fall resumption eventually.

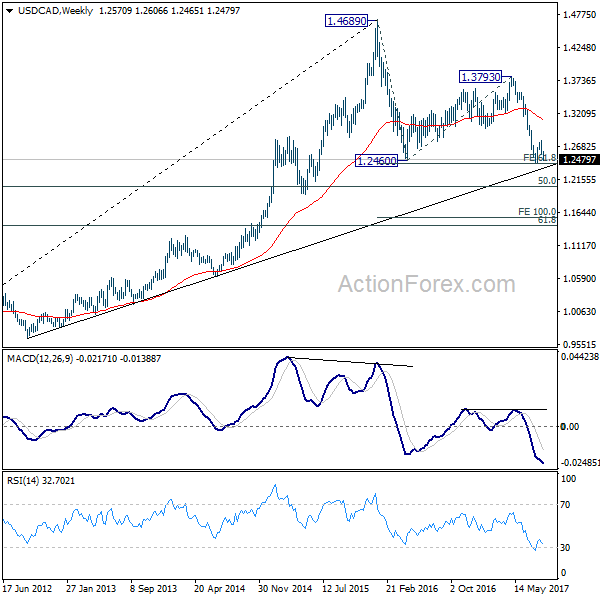

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Such corrective fall is still expected to extend to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. Nonetheless, on the upside, sustained break of 1.2968, 38.2% retracement of 1.3793 to 1.2412 at 1.2940 will be the first sign of completion of the correction and will turn focus back to 1.3793 key resistance.

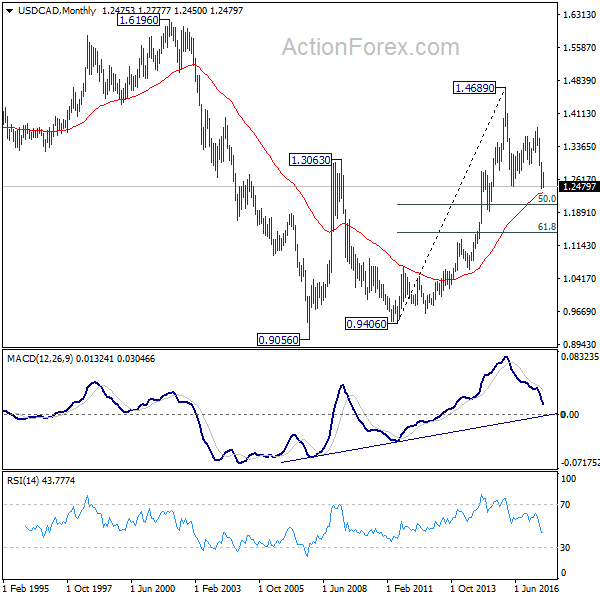

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise is expected to resume later to test 1.6196 down the road. But firm break of 50% retracement of 0.9406 to 1.4869 at 1.2048 will raise doubt over this view. In that case, the long term trend could have reversed.