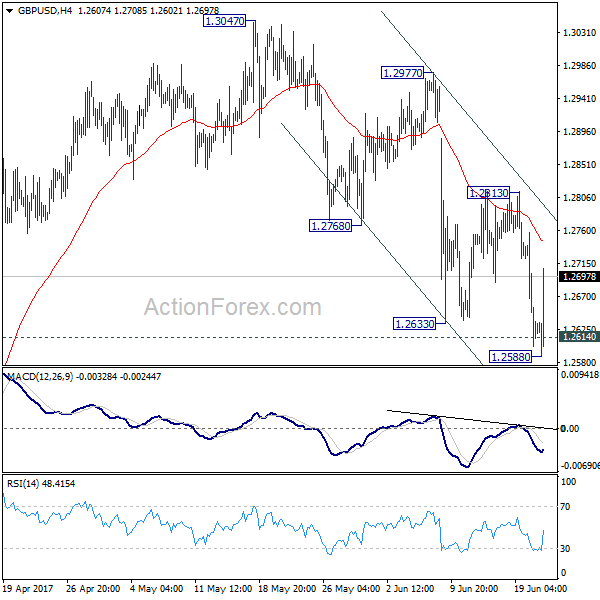

Daily Pivots: (S1) 1.2565; (P) 1.2661; (R1) 1.2721; More…

GBP/USD rebounds strongly after dipping to 1.2588 earlier today. As the pair is trying to draw support from 1.2614 key support level, intraday bias is turned neutral first. Deeper fall is still expected as long as 1.2813 resistance holds. As noted before, we’re still favoring the bearish case that consolidation pattern from 1.1946 has completed at 1.3047 already. Sustained break of 1.2614 resistance turned support should confirm our bearish view and target a test on 1.1946 low next. However, break of 1.2813 resistance will dampen our view and turn bias back to the upside for 1.3047 and above.

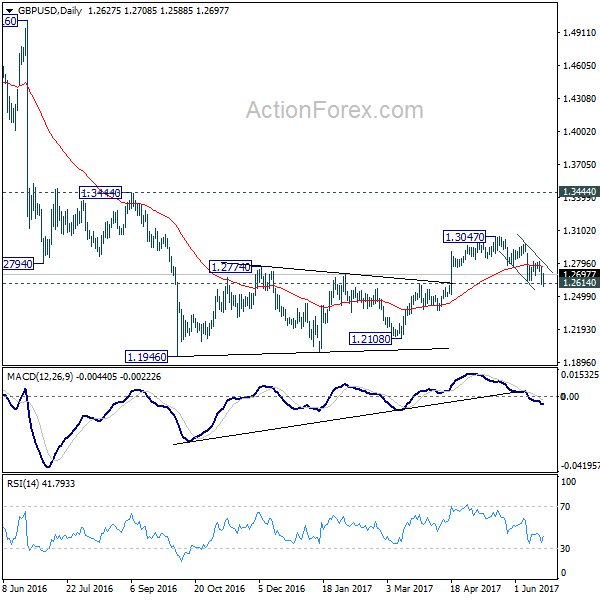

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. Price actions from 1.1946 medium term low are seen as a consolidation pattern, which could have completed after hitting 55 week EMA. Break of 1.1946 low will target 61.8% projection of 1.5016 to 1.1946 from 1.3047 at 1.1150 next. In case the consolidation from 1.1946 extends, outlook will stay remain bearish as long as 1.3444 resistance holds.