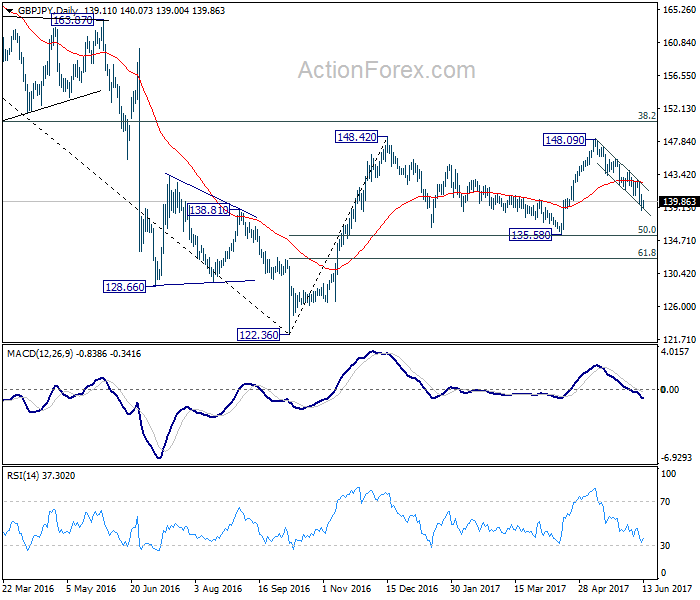

Daily Pivots: (S1) 138.28; (P) 139.54; (R1) 140.42; More….

GBP/JPY recovers mildly after hitting 138.65 but stays well below 142.75 resistance. Intraday bias remains on the downside for 135.58 support. As this level is close to 135.39 fibonacci level, we’d look for bottoming signal around there to bring rebound. However, break of 142.75 resistance is needed to indicate completion of fall from 148.09. Otherwise, near term outlook will say mildly bearish in case of recovery.

In the bigger picture, while the fall from 148.09 is deeper than expected, we’re not bearish in the cross yet. Price action from 148.42 is possibly developing into a sideway pattern with fall from 148.09 as the third leg. Deeper decline could be seen but we’re looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Rise from 122.36 is still mildly in favor to resume at a later stage. However, sustained break of 135.58/39 will confirm reversal and target a retest on 122.36 low.