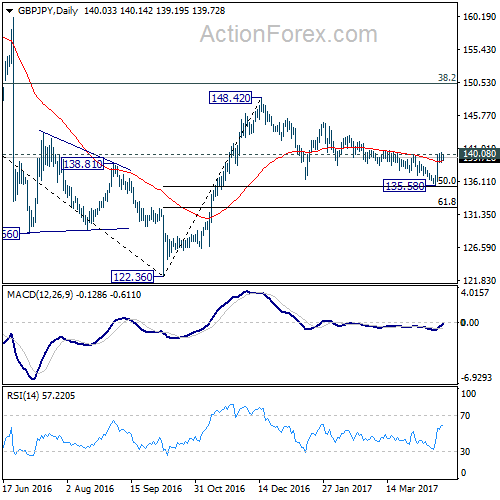

GBP/JPY formed a short term bottom at 135.58 last week, just ahead of 135.39 medium term fibonacci level. The development argues that whole consolidation pattern from 148.42 has completed. But we’d prefer to see decisive break of 140.08 resistance to confirm. At this point, we’re favoring the bullish case and expect further upside in GBP/JPY ahead.

Initial bias in GBP/JPY is neutral this week for some consolidations. But as long as 138.30 minor support holds, further rally is expected. Decisive break of 140.08 resistance should affirm our bullish view and target 144.77 resistance next. However, break of 138.30 will turn focus back to 135.58 low instead.

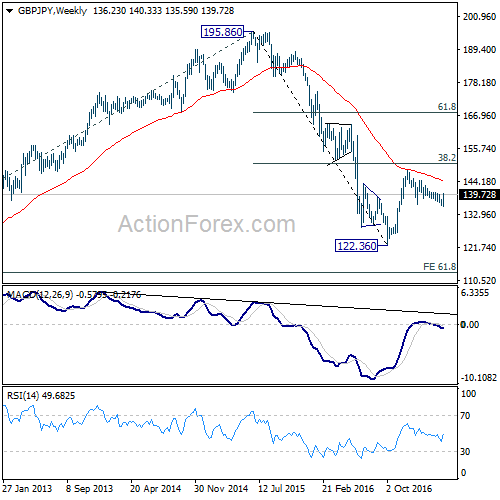

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. As long as 50% retracement of 122.36 to 148.42 at 135.39 holds, another rising leg would be seen to 38.2% retracement of 195.86 to 122.36 at 150.42 and possibly above. However, firm break of 135.39 will bring retest of 122.36, with prospect of resuming the larger down trend from 195.86.

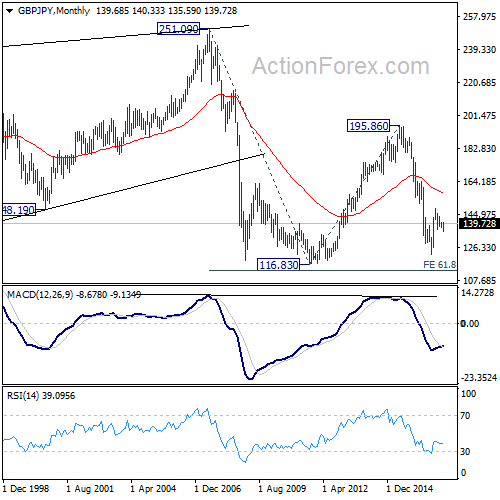

In the longer term picture, while price actions from 122.36 would develop into a medium term correction, fall from 195.86 is still seen as resuming the down trend from 251.09 (2007 high). Hence, after the correction from 122.36 completes we’d expect another fall through 116.83 low.