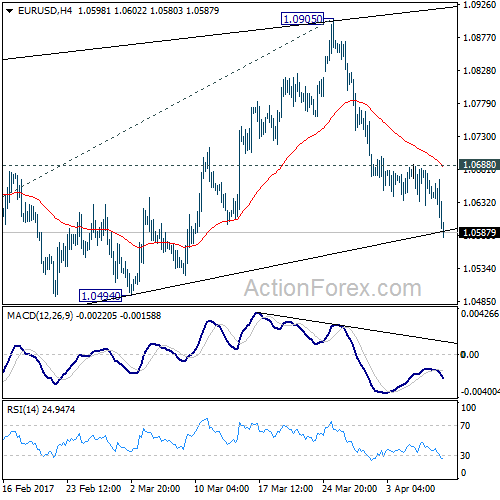

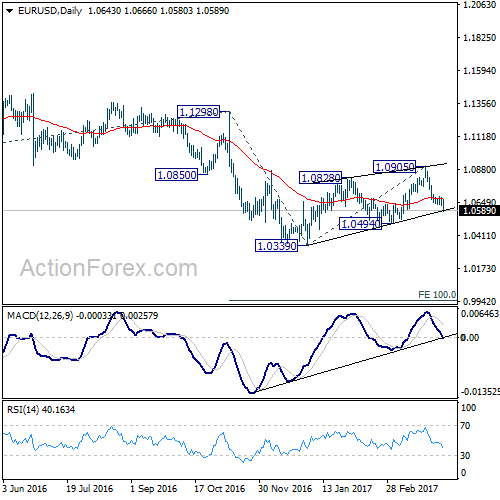

EUR/USD’s fall from 1.0905 extended to as low as 1.0580 last week. The development affirmed the case that corrective rise from 1.0339 is finished after being rejected by 55 week EMA. And, the larger down trend is likely ready to resume. Deeper fall is expected in near term and break of 1.0494 support should confirm this bearish case.

Initial bias in EUR/USD remains on the downside this week for 1.0494 support. Break should confirm completion of the corrective rise from 1.0339. And, larger down trend is likely resuming in this case. Break of 1.0339 will confirm down trend resumption and target 100% projection of 1.1298 to 1.0339 from 1.0905 at 0.9946. On the upside, break of 1.0688 resistance will delay the bearish case and turn focus back to 1.0905 resistance instead.

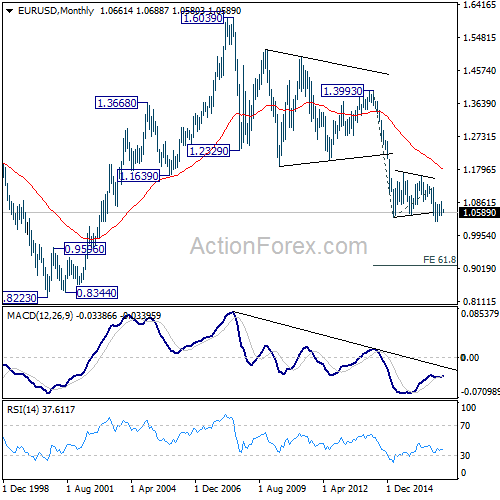

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. this would also be supported by sustained trading above 55 week EMA.

In the long term picture, the down trend from 1.6039 (2008 high) is still in progress and there is no clear sign of completion. We’d expect more downside towards 0.8223 (2000 low) as long as 1.1298 resistance holds. However, firm break of 1.1298 should now confirm long term reversal.