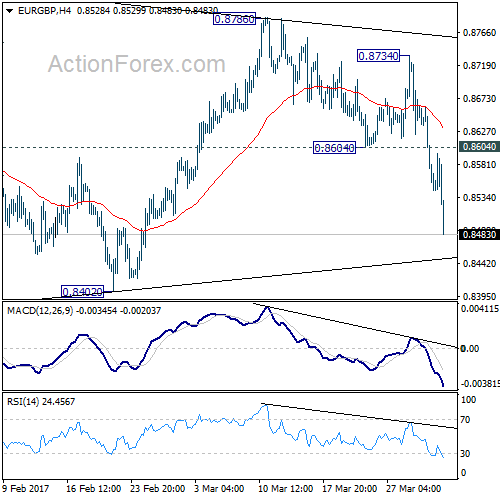

After recovering to 0.8734, EUR/GBP reversed and dropped sharply to as low as 0.8483 last week. The development argues that consolidation pattern from 08303 is completed with three waves to 0.8786. And larger corrective fall from 0.9304 is resuming for a new low below 0.8303.

Initial bias in EUR/GBP stays on the downside this week for 0.8402 support. Break will indicate that larger decline from 0.9304 is resuming. In such case, EUR/GBP should target 0.8303 low and below. As fall from 0.9304 is viewed as a corrective move, we’d expect strong support at 0.8116/20 cluster support to contain downside and bring rebound. On the upside, break of 0.8604 support turned resistance is needed to indicate completion of fall from 0.8786. Otherwise, outlook will remain cautiously bearish in case of recovery.

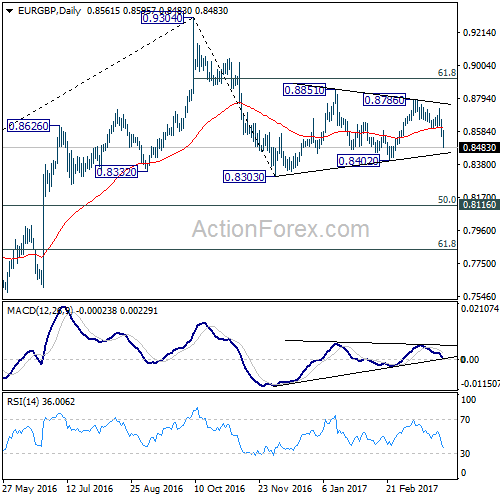

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Such decline is likely ready to resume and should make a new low below 0.8303. At this point, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Break of 0.9304 will pave the way to 0.9799 (2008 high). However, sustained break of 0.8116 could bring deeper decline to next key support level at 0.7564 before the correction completes.

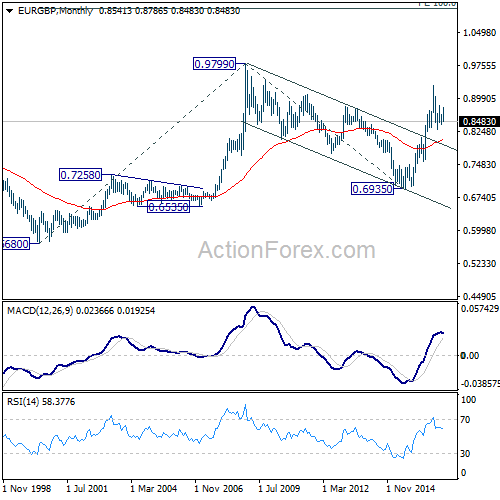

In the long term picture, firstly, price action from 0.9799 is seen as a long term corrective pattern and should have completed at 0.6935. Secondly, rise from 0.6935 is likely resuming up trend from 0.5680 (2000 low). Thirdly, this is supported by the impulsive structure of the rise from 0.6935 to 0.9304. Hence, after the correction from 0.9304 completes, we’d expect another medium term up trend to target 0.9799 high and above.