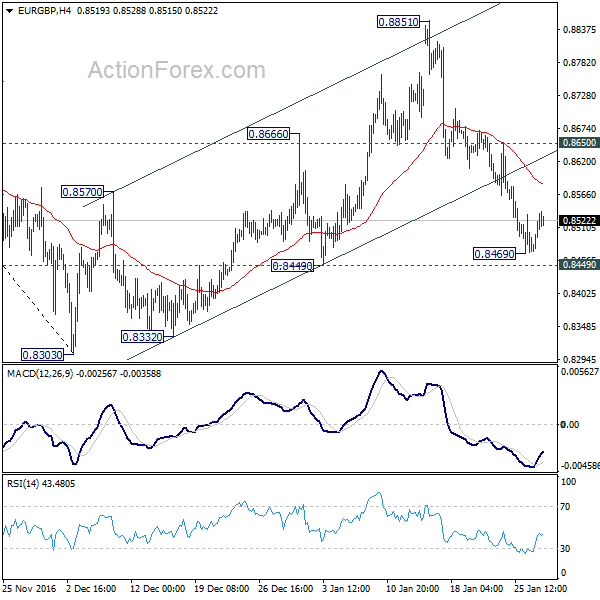

EUR/GBP dropped to as low as 0.8469 last week but lost momentum ahead of 0.8449 support and recovered. Initial bias is neutral this week first. The sustained trading below near term channel suggests that corrective rise from 0.8303 has completed at 0.8851 already. We’d favor deeper fall as long as 0.8650 minor resistance holds. Break of 0.8449 will argue that corrective fall from 0.9304 has started the third leg for 0.8116 cluster support. Nonetheless, break of 0.8650 will turn focus back to 0.8851 instead.

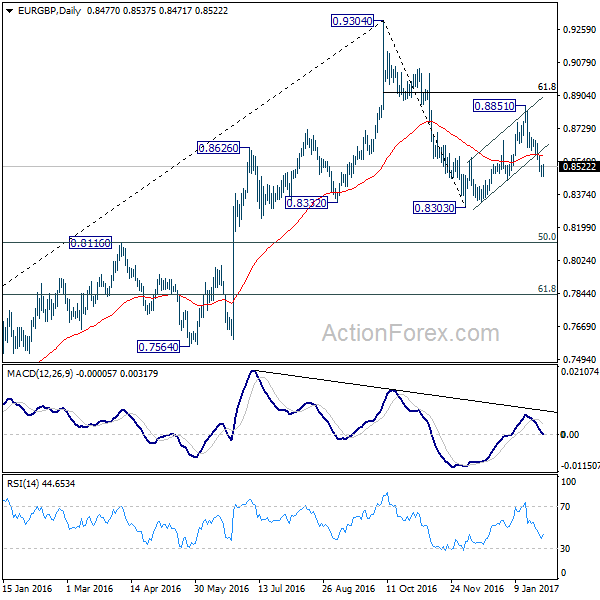

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

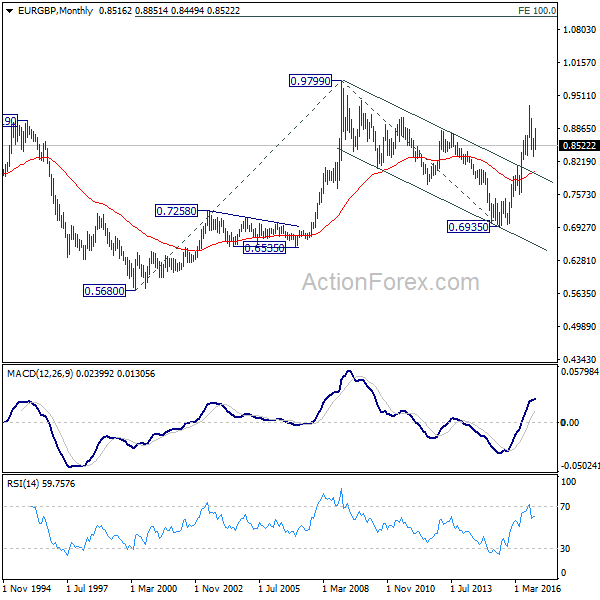

In the long term picture, firstly, price action from 0.9799 is seen as a long term corrective pattern and should have completed at 0.6935. Secondly, rise from 0.6935 is likely resuming up trend from 0.5680 (2000 low). Thirdly, this is supported by the impulsive structure of the rise from 0.6935 to 0.9304. Hence, after the consolidation from 0.9304 completes, we’d expect another medium term up trend to target 0.9799 high and above.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box