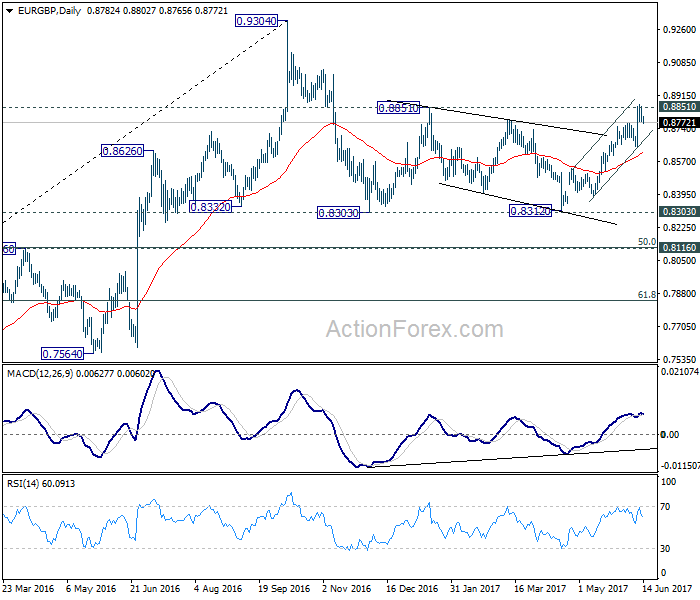

Daily Pivots: (S1) 0.8763; (P) 0.8807; (R1) 0.8834; More…

Despite edging higher to 0.8865, EUR/GBP cannot sustain above 0.8851 resistance and retreated. Intraday bias is turned neutral for some consolidation. At this point, we’d expect 0.8639 support to hold and bring another rise. Firm break of 0.8851 will pave the way to retest 0.8304 high. . At this point, there is no clear sign of larger up trend resumption yet. Hence, we’ll be cautious on topping around 0.9304. However, break of 0.8639 support will now indicate near term topping and bring deeper pull back to 55 day EMA (now at 0.8615) and below.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. The leg from 0.9304 should have completed after testing 0.8332 structural support. But it’s too early to say that larger rise from 0.6935 is resuming. Rejection from 0.9304 will extend the consolidation with another falling leg. Meanwhile, firm break of 0.9304 will target 0.9799 (2008 high). In case of another decline, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound.