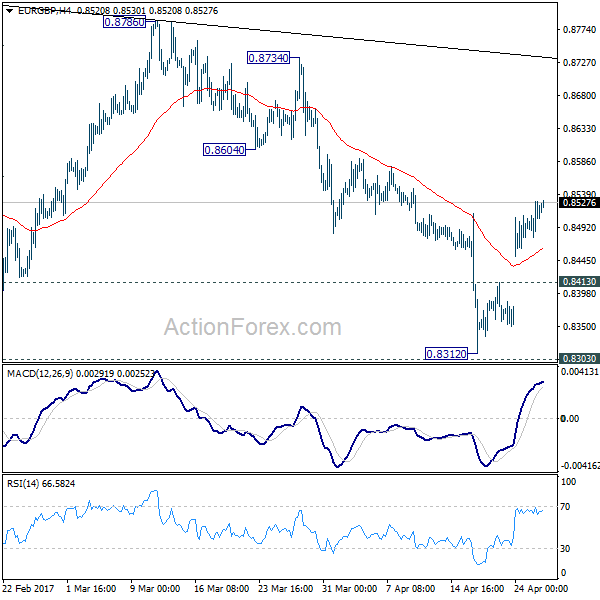

Daily Pivots: (S1) 0.8482; (P) 0.8506; (R1) 0.8535; More…

The break of 0.8511 minor resistance indicates near term reversal in EUR/GBP. And the corrective pattern from 0.8851 could be finished with three waves down to 0.8312, just ahead of 0.8303 support. Intraday bias is turned back to the upside for 0.8786 resistance next. Firm break there could bring further rally towards 0.9304 high. Nonetheless, price actions from 0.9304 are seen as a corrective pattern and there is no clear sign of up trend resumption yet. Hence, even in that case, we’ll stay cautious on strong resistance below 0.9304. On the downside, below 0.8413 minor support with turn focus back to 0.8303 instead.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. In any case, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Rise from 0.6935 (2015 low) will resume at a later stage to 0.9799 (2008 high). However, sustained break of 0.8116 could bring deeper decline to next key support level at 0.7564 before the correction completes.