‘We believe the sluggish employment figures are largely attributable to weather-related noise and do not believe they will greatly dampen expectations of a Fed rate hike in June. Still, US indicators are likely to be patchy for now, sapping the momentum for those with a bullish USD/JPY view.’ – Deutsche Bank (based on FXStreet)

Pair’s Outlook

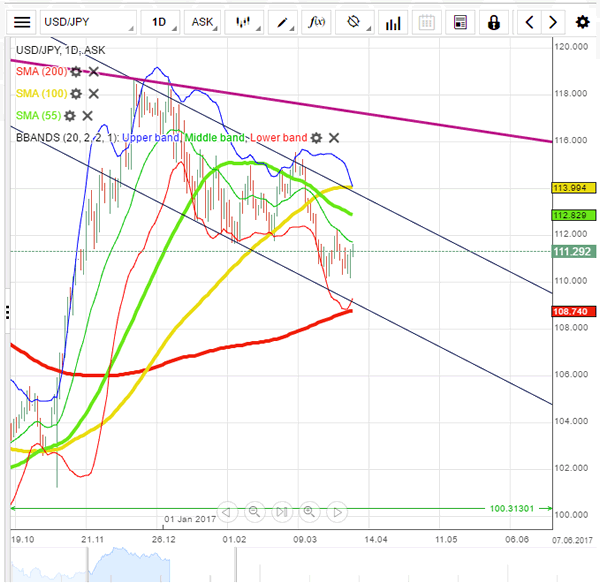

In spite of a poor US NFP reading, the Buck still managed to recover from its intraday low and close trade in the green zone against the Yen on Friday. The recovery reconfirmed the 110.50 level as a tough psychological support, which is likely to keep the USD/JPY pair afloat in case bears take over the market again. The weekly pivot point at 110.93 is now the closest support, but a bearish development is doubtful, even though technical indicators are giving corresponding signals. Meanwhile, a surge beyond 111.70 is also unlikely to occur, being that there are no market movers present and the 20-day SMA and the weekly R1 form relatively strong resistance around that area.

Traders’ Sentiment

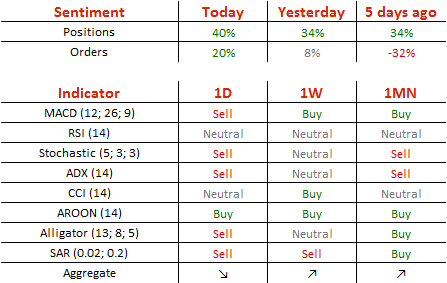

The Greenback appears to be overbought, as 70% of all open positions are long today, compared to 67% on Friday.