‘The (Japanese) central bank’s actions are negative for JGBs and negative for the yen and will be a factor that helps keep dollar/yen supported.’ – BK Asset Management (based on Reuters)

Pair’s Outlook

A strong US NFP reading on Friday was insufficient for the USD/JPY pair to remain elevated, as weak secondary data weighed on the Buck and caused the support area circa 112.60/50 to be retested. Consequently, this area is expected to provide sufficient support today, causing the US Dollar to close trade in the green zone. The weekly pivot point at 113.19 is the closest resistance, but there is no impetus present today, which has the potential to push the pair that high, excluding external factors of course. Meanwhile, technical indicators are unable to confirm the possibility of the positive outcome.

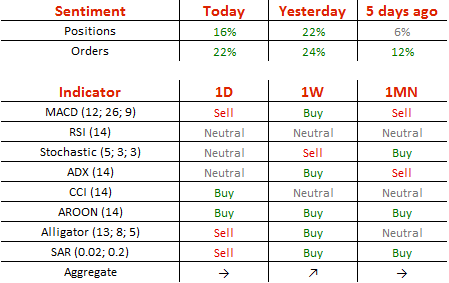

Traders’ Sentiment

There are 58% of traders with a positive outlook towards the US Dollar today, compared to 61% on Friday. At the same time, the share of buy orders inched up from 62 to 61%.