‘We think that price developments so far this year, together with investors realizing that there has to be a significant risk premium priced into the USD and the recent noteworthy shift towards a ‘weak dollar policy’ suggest that the risks for a deeper correction lower in the US currency are increasing.’ – UniCredit Research (based on PoundSterlingLive)

Pair’s Outlook

The GBP/USD pair managed to erase most of Monday’s losses yesterday, but with the 1.26 mark once again providing sufficient resistance, preventing the Cable from edging further up. Today the Pound could go sideways, with the 100-day SMA at 1.2481 expected to limit any possible losses. However, technical studies suggest a positive development could occur, in which case the main target will be the 1.27 mark, where the 23.60% FIbo, the weekly R1 and the upper Bollinger band form relatively strong resistance. The given pair is unlikely to surge significantly beyond 1.26, unless weak US fundamentals provide sufficient impetus today.

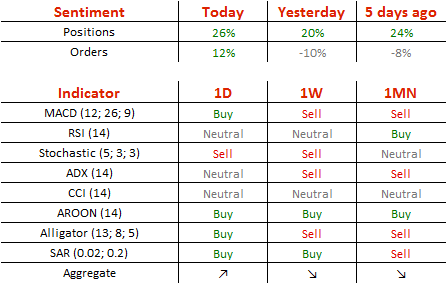

Traders’ Sentiment

Now 63% of traders are long the Sterling (previously 60%), whereas 56% of all pending orders are to acquire the Pound (up from 45%).