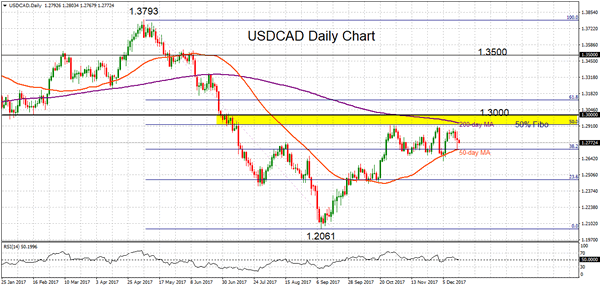

USDCAD remains neutral as it continues to trade in a range from late October. Near-term risk is tilted to the downside. The retracement of the longer-term downtrend from 1.3793 to 1.2061 has not reversed yet. However, the market is capped at the 200-day moving average.

The bounce off the more than a 2-year low from 1.2061 in September to October has moved into a consolidation phase between two key Fibonacci retracement levels of the 1.3793 to 1.2061 downleg. The 38.2% and 50% Fibonacci levels now act as support and resistance at 1.2717 and 1.2922.

USDCAD may find it challenging to break above the zone between the 50% Fibonacci and the key 1.3000 level. But a sustained break would shift the bias to a more bullish one and improve the odds for a move towards 1.3500 and then to the peak at 1.3793.

Near-term momentum is weak and RSI is falling, keeping risk to the downside but strong support is expected at the lower range between 1.2717 (38.2% Fibonacci) and 1.2623 (December 5 low). A break below this area would increase downside pressure and send prices towards the 1.2500 handle and possibly the 1.2061 low.

Overall, USDCAD has changed very little since trading in its well-established more than 2-month old range. The odds are not strong for a change in the broader trend yet as long as the pair trades below the 200-day MA and below 1.3000.