- Commitments of Traders aggregate net bullish open positions of large speculators in the Gold futures market have flashed a bearish contrarian condition.

- The recent rally in Gold (XAU/USD) has been primarily driven by an increase in geopolitical risk premium arising from Middle East tensions. A lack of fresh catalysts after the latest Iran retaliation offensive moves toward Israel increases the risk of profit-taking activities in Gold (XAU/USD).

- Watch the key short-term pivotal resistance of US$2,390 on Gold (XAU/USD).

Gold (XAU/USD) has had a fantastic performance year-to-date with a gain of +15% as of last Friday, 12 April surpassing both the two major US stock indices; S&P 500 (+9%), and Nasdaq 100 (+10%) over a similar period.

The bulk of its current yearly gain has taken place in the prior month of March (+9%), and April (+5.5% month-to-date as of 15 April) as its price actions staged a bullish breakout above a major range resistance of US$2,075 in place since early August 2020.

Also, the current bullish tone seen in Gold (XAU/USD) has been reinforced by rising geopolitical risk premiums, primarily from the Middle East with ongoing fears of tit-for-tat retaliation maneuvers between Israel and Iran over the ongoing Israel-Hamas war.

In the past two months, the inverse relationship between Gold (XAU/USD) and the US 10-year Treasury real yield has broken down due to an increasing odd of stagflation risk revival via the conduit of higher oil prices (from ongoing Middle East tensions that may trigger a supply side reduction or disruption in oil flows) that eventually sees higher inflationary expectations that prevent the US Federal Reserve from enacting an aggressive interest rate cut cycle, in turn may dampen aggregate demand through a higher cost of funding environment.

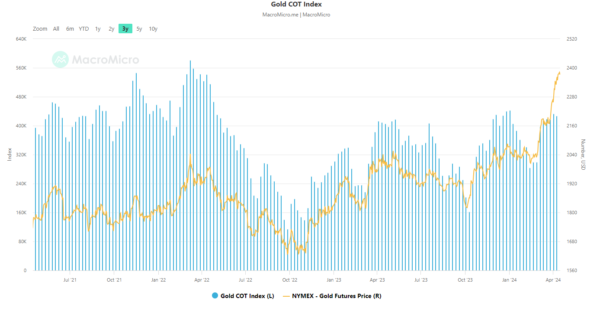

Large speculative players’ net bullish positioning hit an extreme level

Fig 1: Commitments of Trader large speculators’ net positioning in Gold futures as of 8 April 2024 (Source: Macro Micro, click to enlarge chart)

Based on the latest data Commitments of Traders data as of 8 April 2024 (compiled by Macro Micro), the aggregate net bullish open positions of large speculators in the gold futures market of NYMEX (after offsetting the aggregate positions of large commercial hedgers) have risen to +427,001 contracts (net long), its highest level in almost two years with +431,020 contracts recorded on 2 May 2022 (see Fig 1).

Given that net open large speculative positioning flows (primarily from hedge funds) are contrarian in nature which suggests that a relatively high level of net positioning is likely to see an opposite reaction in price actions.

In the current context of Gold (XAU/USD) movements, the risk of further profit-taking activities cannot be ruled out as it recorded a loss of -1.2% last Friday, 12 April, its worst daily performance since 13 Feb 2024 after hitting a fresh intraday all-time high of US$2,431.

Since large speculators have committed a relatively high amount of net bullish open positioning, a further potential rise in Gold (XAU/USD) needs to have fresh catalysts as last week’s rally has been in anticipation of Iran’s retaliation attacks on Israel which has already taken effect on last Saturday.

Therefore, lack of fresh catalysts in the Middle East to drive up geopolitical risk premium (the main factor that is leading the two-month bullish movement in gold prices), Gold (XAU/USD) may eventually see late buyers rushing to exit their positions which increases the risk of a liquidity cascading downward effect on Gold (XAU/USD) prices in the short-term.

An overstretched uptrend increases the risk of corrective mean reversion decline toward the 20-day moving average

Fig 2: Gold (XAU/USD) medium-term trend as of 15 Apr 2024 (Source: TradingView, click to enlarge chart)

Fig 3: Gold (XAU/USD) short-term trend as of 15 Apr 2024 (Source: TradingView, click to enlarge chart)

Considering the relatively high level of net bullish positioning in large speculators toward gold futures as highlighted earlier, it does not imply with certainty that the next price action movement for Gold (XAU/USD) is a medium-term bearish reversal.

So far, the short and medium-term uptrend phases for Gold (XAU/USD) remain intact as current price actions continued to oscillate above its 20-day and 50-day moving average.

Based on a statistical and technical analysis standpoint, the two-month rally of +19% hit a current all-time intraday high of US$2,431on last Friday and is considered overstretched as its price actions hit more than two positive standard deviations away from its 20-day moving average (the mean). Hence, a short-term minor corrective pull-back may be imminent at this juncture.

This overstretched upside price actions observation can be illustrated clearly with the steep upmove seen in the daily Bollinger BandWidth indicator where it rose to 0.14 last Friday, its highest level since 13 August 2020 (see Fig 2).

In addition, the daily RSI momentum indicator has traced out a bearish divergence condition at its overbought region which increases the odds of the mean reversion decline scenario.

Watch the US$2,390 short-term pivotal resistance on Gold (XAU/USD), a break below near-term support of US$2,327 exposes the next intermediate supports at US$2,300 and US$2,260 (also the upward-slopping 20-day moving average) (see Fig 3).

On the other hand, a clearance above US$2,390 invalidates the corrective minor mean reversion decline scenario for a continuation of the impulsive upmove sequence for the next intermediate resistance to come in at US$2,450 in the first step.