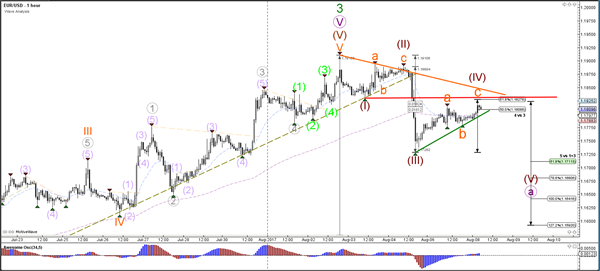

Currency pair EUR/USD

The bearish EUR/USD daily candle on Friday did have a bearish impact on Monday’s price action and price is moving higher. There are, however, strong resistance trend lines (red/orange) present at 1.1825, which offers point of confluence (POC) that could turn price back down. The uptrend could still be alive if price manages to break above this POC zone and the previous top at 1.19.

The EUR/USD could be building an ABC (orange) correction within wave 4 (brown). The bearish breakout below support (green) could indicate a wave 5 (brown) continuation to complete wave A (purple). The wave 4 is invalidated if price breaks above the 61.8% Fib and resistance line (red).

Currency pair USD/JPY

The USD/JPY is building an ABC (orange) zigzag within a larger ABC correction (brown).

The USD/JPY is probably in a wave 4 (purple) as long as price stays above the top of wave 1 at 110.25. A more likely turning spot could be the 50% Fibonacci level of wave 4 vs 3.

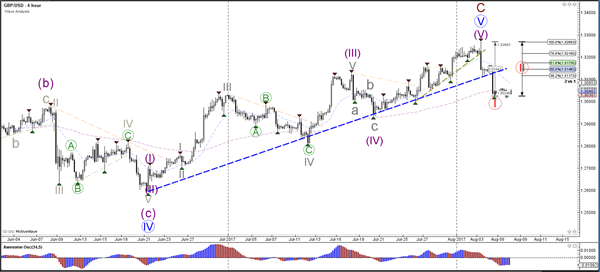

Currency pair GBP/USD

The GBP/USD could be in a bearish breakout via a wave 1-2 (red) after the Cable broke below the support trend line (dotted blue).

The GBP/USD seems to have completed 5 waves (purple) within wave 1 (red) and is now building a potential ABC (purple) within 2 (red).