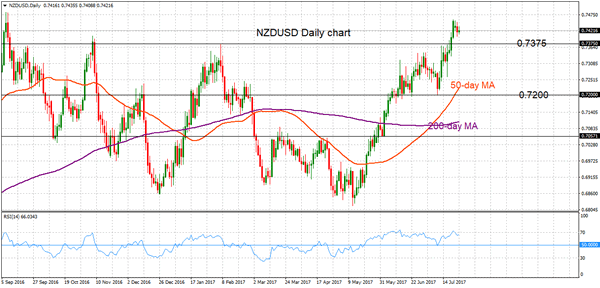

NZDUSD has been in an uptrend since the May 11 low of 0.6816 to the July 21 high of 0.7457. There was a slight corrective move lower from this peak as the market reached overbought levels, which was indicated by the RSI rising above 70.

The technical picture remains bullish as there was a bullish crossover of the 50-day moving average with the 200-day MA on July 5. The loss in upside momentum suggests some consolidation in the near term with immediate support expected at 0.7392 (July 21 low).

Failure to clear the 0.7457 high increases the risk of a short-term top being put in place, especially amidst overbought conditions in the market. However, only a break below the key psychological level of 0.7200 would start to shift the bullish bias. An important support level comes in at 0.7057. For now there are no clear signs of a shift in the May to July uptrend.

Looking at the bigger picture, NZDUSD needs to continue trading above 0.7375 in order to maintain the current bias. Falling back below this level would bring the bias to neutral. A sustained break of 0.7457 is needed in order to open the way to target the September 2016 high of 0.7484. The rising 50-day moving average supports a bullish bias.