Price looks undecided and uninspired on the Daily chart and could decrease again if the USDX will have enough energy to climb much higher on the short term. GBP/USD is trading much above the 1.3000 psychological level, maintaining a bullish perspective as long as this support remains intact.

The buyers seem exhausted on the Daly chart, price failed to reach the 1.3111 previous high, signalling that he could slip lower to test and retest a support level.

The United Kingdom data could bring life on the GBP/USD, the Prelim GDP could increase by 0.3% in the second quarter and could beat the 0.2% growth in the former reading period, while the BBA Mortgage Approvals could decrease from 40.3K to 39.9K. Moreover the Index of Services is expected to increase by 0.4% in May.

You should be careful today because we may have a high volatility after the FOMC Statement and after the Federal Funds Rate will be released. As you already know, the interest rate is expected to remain steady at 1.25% in the upcoming period.

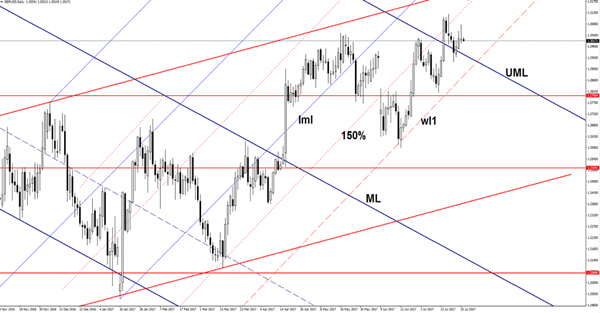

Price decreased a little after the yesterday’s indecision, could come down to retest the upper median line (UML) if the dollar index will resume the minor rebound. Right now is premature to say that we’ll have a broader rebound on the USDX because is trapped below a strong dynamic resistance.

GBP/USD looks too overbought on the short term, so technically should drop towards the warning line (wl1) of the ascending pitchfork, could be attracted by the confluence formed between the upper median line (UML) of the major descending pitchfork with the warning line (wl1). The outlook is bullish as long as is trading above the mentioned support levels, but a valid breakdown below the wl1 and below the UML will open the door for a major drop.