The currency pair has decreased since yesterday and could come down to test and retest the support levels before will climb much higher. Is trading much above the 129.50 psychological level and maintains a bullish perspective on the Daily chart.

Looks like that is consolidation because needs to recapture more directional energy before will approach new highs, we have to wait for a confirmation that will continue the upside movement. We have to be careful because the Yen could start another leg higher if the Nikkie stock index will drop further.

The JP225 moves sideways on the short term, remains to see if this will be an accumulation or a distribution movement. The index looks a little exhausted on the Daily chart and failed once again to stay above the 20058 static resistance and could come down to retest the 19700 major static support, a valid breakdown will confirm a major drop in the upcoming period.

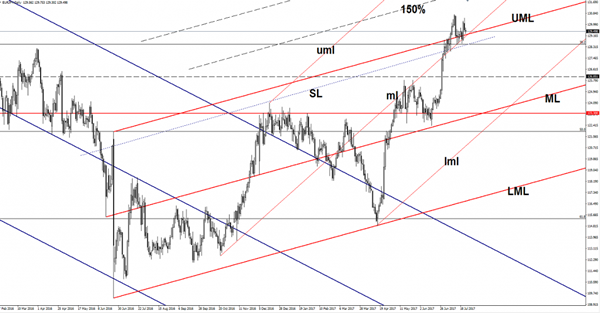

Price is expected to retest the upper median line (UML) of the major ascending pitchfork and the median line (ml) of the minor ascending pitchfork, we have a strong confluence between these levels, we’ll see how will react when will hit this zone.

We’ll have a perfect buying opportunity if the support levels will hold and if will reject the price again, only a breakdown through the confluence area will accelerate the sell-off.

Support can be found also at the 38.2% retracement level and at the sliding line (SL), so only a valid breakdown below these levels will confirm a large drop.

The next upside target remains at the 130.76 previous high, could be attracted by the 150% Fibonacci line (ascending dotted line) as well.