‘The biggest driver of gold has been the relatively weak U.S. dollar.’ – Jiang Shu, Shandong Gold Group (based on Reuters)

Pair’s Outlook

During the last trading session the yellow metal stopped the jump, which was the result of a breakout out of a triangle pattern. The surge stopped at the 1,260 level, where the 200-day SMA was and still is located at. As a result with a new week a decline has begun, and the bullion’s price is set to decline to the 1,248.96 level, where the 50.00% Fibonacci retracement level is located at. In addition, the Fibo is also supported by the newly calculated weekly PP, which is located at the 1,247.55 level.

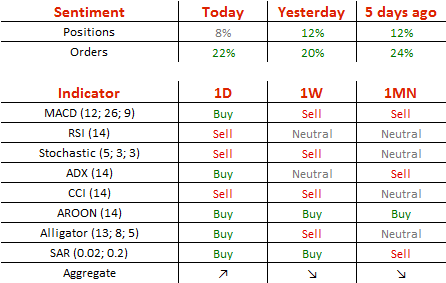

Traders’ Sentiment

Traders remain long on the metal, as 54% of SWFX open positions are long. In addition, 61% of trader set up orders are set up to buy the bullion.