Currency pair EUR/USD

The EUR/USD bullish momentum continued strongly yesterday breaking above 1.11 and heading towards the next round level of 1.12. The bullish push can be explained by the wave 3 pattern (purple) which is known for its strong momentum. The bullish momentum could now however reach a moment where it will be retracing for a corrective wave 4 (purple). The Fibonacci levels of wave 4 could act as support.

On one time frame higher the EUR/USD could be building an ABC (blue) zigzag which could face resistance at the 88.6% Fibonacci level.

Currency pair USD/JPY

The USD/JPY continued with the ABC (brown) zigzag correction yesterday, which has reached the 61.8% Fibonacci level (of the 5 waves (brown)). This could cause a retracement.

The USD/JPY bearish third wave 3 (orange) seems to have reached a support level which could cause a wave 4 (orange) correction. The Fibonacci levels of wave 4 (orange) are therefore potential resistance levels.

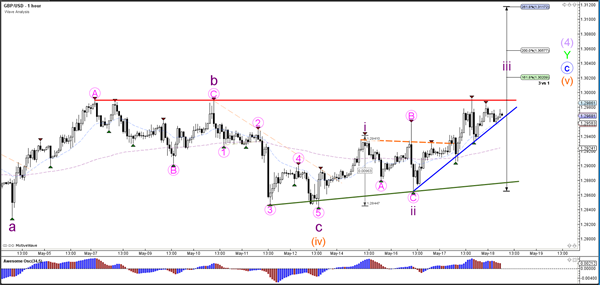

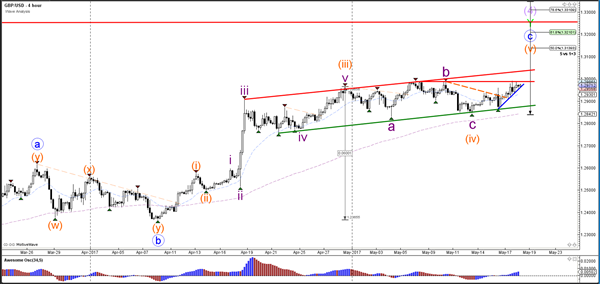

Currency pair GBP/USD

The GBP/USD remains in an uptrend channel (red/green) and price is challenging the top (red). Price poked through the previous top and hence a bullish wave 5 (orange) seems more likely at this moment.

The GBP/USD break above resistance (red) could see a wave 3 (purple) develop whereas a break below support (blue) could see price continue within the correction.