‘GBP/USD should be capped in front of raised range resistance (1.30-32) and is likely to slide back towards the centre of its 1.20-1.32 rang.’ – Westpac (based on FXStreet)

Pair’s Outlook

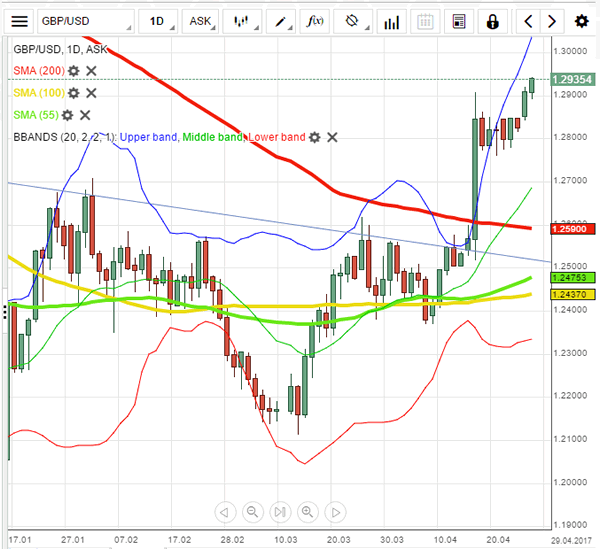

Downbeat US fundamental data caused the Cable to appreciate again and break out from its consolidation trend yesterday. Despite the breakout, the GBP/USD currency pair is still unlikely to keep posting gains, due to the monthly R2, the weekly R1 and the upper Bollinger band forming resistance just 50 pip from today’s opening price. Furthermore, the still not fully confirmed broadening rising wedge’s resistance line passes through that area, thus, providing additional resistance. Meanwhile, the nearest support lies only around 1.2745, but a drop that low is unlikely to occur, with the 1.28 mark expected to be the lowest possible level.

Traders’ Sentiment

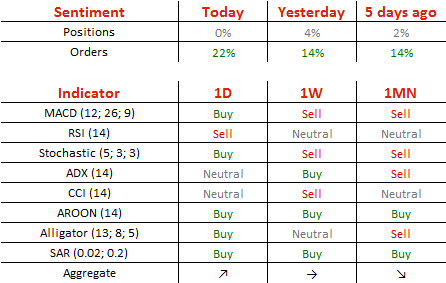

Market sentiment once again reached a perfect equilibrium, but the portion of orders to acquire the Sterling edged up from 57 to 61%.