‘The first phase of negotiations with the EU [over Brexit] will be marked by sharp discord that is likely to be negative for the pound.’ – BMO Capital Markets (based on Business Recorder)

Pair’s Outlook

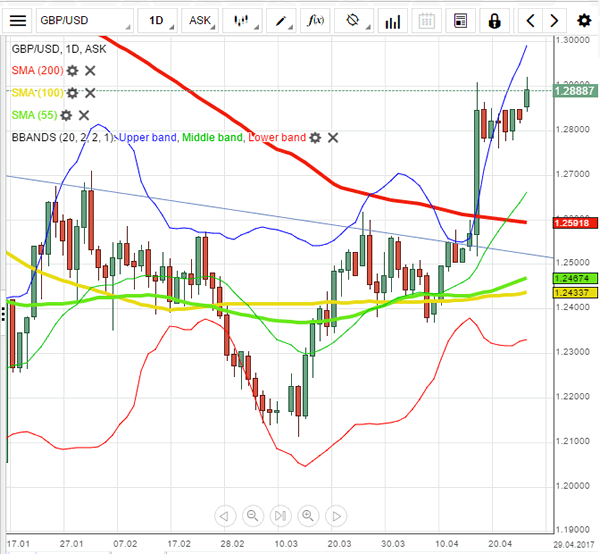

Wednesday ended with the British currency erasing all intraday losses against the US Dollar, but with no significant gains registered. A close barely above the 1.2850 psychological resistance now allows the Cable to continue edging further up, with the monthly R2, the weekly R1 and the upper Bollinger band forming another supply area around 1.2950. Although technical indicators support the possibility of another rally, the tide could still turn once the US fundamentals are released later today. Upbeat data is likely to provide the Greenback with a boost, in which case the Cable’s consolidation trend would be preserved.

Traders’ Sentiment

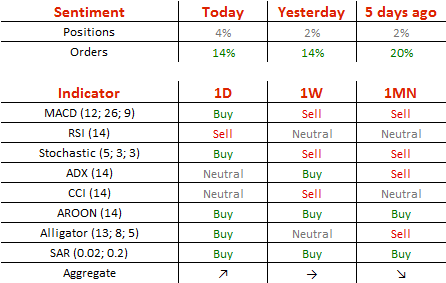

There are slightly more bulls today, namely 52% (previously 51%). At the same time, the number of orders to acquire the Sterling remained unchanged at 57%.