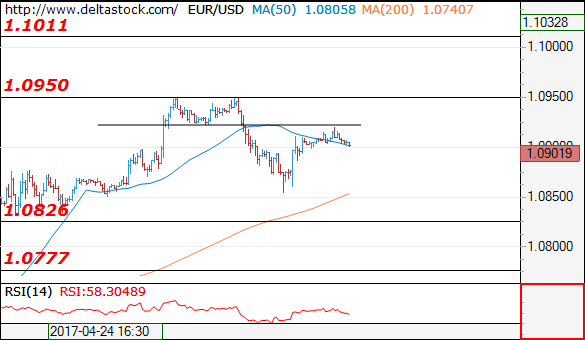

EUR/USD

Current level – 10901

The recent break through 1.0920 led to s dip to 1.0854, but it wasn’t enough to initiate a more substantial downswing, so the outlook on the senior frames is still positive, with a risk of a rise towards 1.1010 area. Initial intraday resistance lies at 1.0920 and key support is projected at 1.0826.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.0920 | 1.0950 | 1.0826 | 1.0780 |

| 1.0950 | 1.1010 | 1.0780 | 1.0676 |

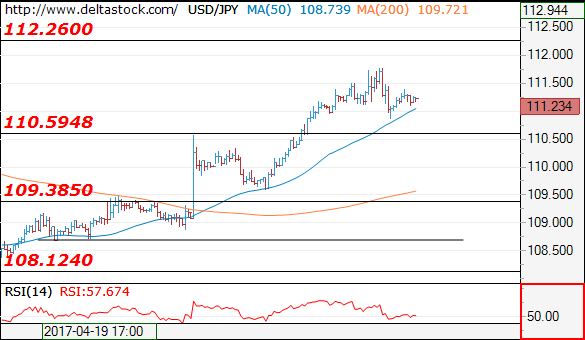

USD/JPY

Current level – 111.23

A minor reversal at yesterday’s peak at 111.75 signals a negative bias, for a slide towards 110.50 support zone.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 111.75 | 112.26 | 110.50 | 109.40 |

| 112.26 | 113.50 | 109.40 | 108.12 |

GBP/USD

Current level – 1.2867

The intraday outlook is positive and a break through 1.2904 high will target 1.3000 sentiment area. Crucial support lies at 1.2803 low.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2904 | 1.3000 | 1.2770 | 1.2610 |

| 1.3000 | 1.3500 | 1.2705 | 1.2510 |