‘Should the yen be bought, if the Korean situation is so nearby? But buying the yen seems to be the established market reaction, and if you’ve been around long enough, you know you don’t go against the market.’ – State Street Bank and Trust (based on Reuters)

Pair’s Outlook

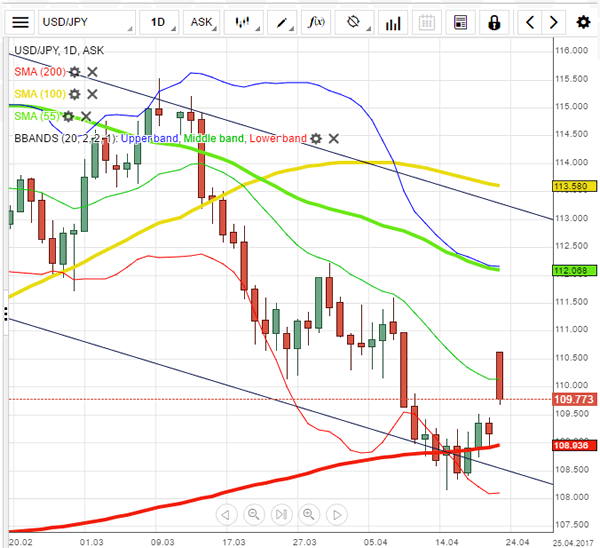

The Greenback underwent a corrective decline on Monday, but the losses against the Yen slightly exceeded expectations, as trade closed below the 110.00 major level. Where the given psychological support failed, the weekly R1 at 109.71 succeeded, but that does not imply that bulls are to continue pushing the Buck further up. Downside risks still persist and technical indicators support that. Nevertheless, in case the USD/JPY slips below 109.50, the tough demand cluster around 109.00 is expected to cause the pair to rebound. On the other hand, the nearest significant resistance rests only at 111.00, therefore, the US Dollar has sufficient space for a bullish development today.

Traders’ Sentiment

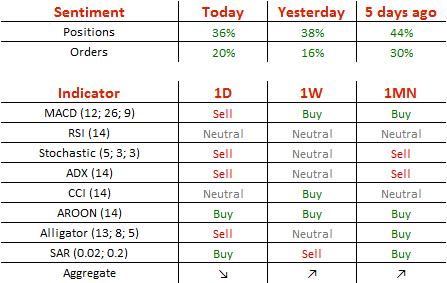

Today 68% of traders are long the Buck (previously 69%), while the share of buy orders edged higher from 58 to 60%.