Unnoticed this morning, Euro made a double top, which means USD/JPy may have better value going forward.

We won’t dwell on Macron’s victory yesterday as much has and will be written. The overall effect should be neutral to small bullish on European bonds, stocks and equities as he will not control the legislature after the Parliamentary elections. This will mean compromises and coalitions and almost certainly a policy agenda that will move as fast the French civil service.

Naturally, it has been a risk on day with Asia indices rallying along with Yen crosses. EUR gapped nearly 200 points higher from Friday to trade as high at 1.0907 before spending the day drifting back to 1.0850. USD/JPY gapped higher as well, trading above the 110.00 level as EUR/JPY also gapped.

The reason I keep mentioning gaps is because they’re well, gaps. Have we gaps on charts everywhere thanks to the EUR/USD and USD/JPY jumping in the twilight hours of the morning. EUR/GBP, GBP/JPY, AUD/JPY/ CHF/JPY, EUR/TRY, you pretty much name it. If it has an EUR or a JPY in it has a gap on its charts this morning. Have a look at your one-minute charts, and you will see what I mean. The problem with gaps is that from a technical and purely trading perspective, they usually get filled back in. Particularly ones that happen at the market open at 2 am on a Monday in Singapore.

This is not always the case I must qualify, but it is very often the case. In Euro’s case, the gap is much bigger then JPY’s and potentially more damaging to Euro bulls technically as we shall see. Traders, in fact, may find the USD/JPY and XXX/JPY set-up more intriguing than EUR/USD over the next few days.

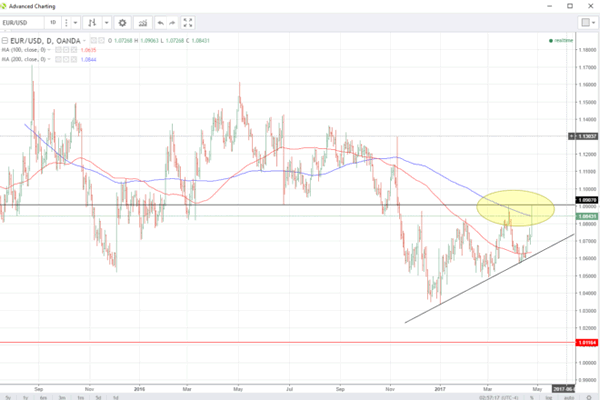

EUR/USD

Almost unnoticed this morning, EURO jumped nearly 200 points from the New York close and then spent the rest of the day drifting lower. In the process, it traced out a potential double top at 1.0907. I say potential because it will only be confirmed if we are under 1.0907 at the New York close.

This does bear watching though, especially in the context of my comments on gap filling above. The formation itself also appears to still be an ascending wedge/triangle in a greater downwards trend. This is a bearish consolidation pattern for technicians. Thus the double top could be quite significant if it holds in the bigger picture.

Euro has resistance at the 1.0907 level, but a daily close and consolidations above open the way to 1.1300 in technical terms.

Support lies at 1.0730, then the 100-day moving average at 1.0635 followed by the rising trendline at 1.0610.

USD/JPY

In the Euro noise today, USD/JPY went about its business quietly. Gapping some 100+ points higher to 110.60, it broke some important technical levels and had consolidated above them.

Firstly its downtrend at 109.50 was taken out and then the all important pivot, 110.00. These now become support.

Resistance lies at 111.60 with the 100 DMA at 113.50. The higher they climb, the harder they fall, and with a larger gap, Euro has more potential to fall should it fill that gap up.

EUR/JPY

Don’t let all the lines and colours scare you, concentrate on the big picture.

EURJPY has gapped from 117.10 to 120.60 this morning before retracing its way back to 119.35. Along the way, it broke its downtrend line at 117.40, and the 200-DMA at 117.85. These now become support albeit quite far away. (Hence gap filling can be a little scary)

Today’s high at 120.35 is the first resistance followed by the 100-DMA at 120.65 before another resistance line at 122.25.

The Ichi moko cloud, although rather scrawny as it sits at 121.00 will also provide some resistance.

Overall the EUR/JPY has a lot more wood to chop technically than the USD/JPY.

AUD/JPY

The AUD/JPY is one of the highest beta crosses to investor risk appetite, and it didn’t disappoint today. Breaking out of its month-long down channel at 82.30 before proceeding straight to go, reaching a high of 83.95. 82.30 along with formerly interim resistance at 83.35 become support.

Resistance lies at 83.95, the daily high, and then the congestion region around the 85.00 level.

SUMMARY

Also, the attention has been on the EURO today, from a technical perspective, USD/JPY and the JPY crosses have all had more constructive days. The 1.0907 double top in EUR has the potential to become a very significant level now. Traders should also “mind the gaps” on many crosses and the EURO after this morning’s price action.