Sunrise Market Commentary

- Rates: Testing times for German 10-yr yield

The German 10-yr yield closed just above key support in the 0.3% area yesterday. A break lower would suggest a return to the downside of this year’s sideways trading channel (0.2%). Rumours about increased focus on long tenors (30y and even 50y) in next year’s German funding plan could avert a break. - Currencies: USD extends cautious rebound

The dollar held up well yesterday even as risk sentiment was negative for most of the day. The trade weighted dollar even extends an, albeit very gradual, comeback. The jury is still out, but at least the USD downside looks better protected. Tomorrow’s US payrolls hold the key on a next directional move. Or will US politics spoil the game.

The Sunrise Headlines

- US stock markets murmured around opening levels to close mixed between -0.2% (Dow) and 0.2% (Nasdaq). Asian equity indices trade mixed overnight with a significant outperformance of Japan.

- The BoC kept policy rates on hold yesterday at its last interest rate decision of 2017 and reiterated it will be “cautious” with future moves, indicating it’s in no rush to cool an economy that is very close to capacity.

- A European Parliament resolution drafted on Monday shows British PM May has secured agreement from Brussels that British citizens in the EU will be able to live freely in any member state after Brexit, according to Reuters.

- BoJ Governor Kuroda stressed the need to look at the impact monetary policy has on the banking system and said changes in the economy could trigger a hike in the bank’s yield targets, offering the strongest signal to date it may edge away from its crisis-mode stimulus programme.

- China should prioritise financial stability above development goals, as pursuit of regional growth targets and helping firms avoid heavy job losses had led to a surge in debt, particularly at local government level, the IMF said.

- Policymakers at the Brazilian central bank cut the benchmark Selic rate by 50 bps to a historic low of 7% as inflation continues to drop while the economy inches forward from a brutal recession.

- Today’s eco calendar contains the final Q3 EMU GDP number and US weekly jobless claims. ECB Draghi speaks in his capacity as chair of the GHOS. Spain and France supply the EMU bond market

Currencies: USD Extends Cautious Rebound

Dollar maintains cautious gains

Asian markets were captured by a global risk-off correction yesterday. However, the spill-overs to the interest rate and FX markets were modest. The dollar held up well despite the decline in core/US yields. Risk sentiment improved slightly in US trading and lifted USD/JPY a bit further off the intraday lows. The pair closed at 112.29 (from 112.60). EUR/US finished at 1.1796 (from 1.1826).

Asian equities still show a diffuse picture overnight. Japan outperforms with gains of 1% +. China and Korea underperform. The profit taking move of the previous sessions slows, but there is no big story to start a clear directional move/rebound. USD/JPY trades in the mid 112 area. The pair lost only limited ground in yesterday’s risk-off correction. BoJ governor Kuroda in a speech said that the shape of the yield curve could change depending on the economy, inflation or factors in the financial system. There was no market reaction. EUR/USD stabilizes in the 1.18 area. At 93.60, the trade-weighted dollar (DXY) holds near the highest level in 2 weeks. The Aussie dollar lost further ground as the trade surplus narrowed much more than expected in October. AUD/USD reversed its recent rebound and trades again in the mid 0.75 area.

There are only second tier eco data in the EMU and the US today. The details of the final EMU Q3 GDP are interesting but outdated and no market movers. This also applies for production data from EMU countries. US jobless claims are expected to stabilize at 240k. Markets will count down to tomorrow’s payrolls. Investors will also keep an eye on the US tax bill debate and look out whether the US can avoid a partial government shut-down. Markets are not really worried on this issue.

Earlier this week, there were tentative signs that the dollar was receiving support from the protracted rise in ST US yields (2-y US yield rising above 1.8%). Markets are gradually moving in the direction of the Fed guidance (dotplot). For now, it didn’t help the dollar that much, but maybe it helped to provide a floor for the US currency as USD shorts are becoming expensive. This process might be aborted if global markets fall prey to an outright risk-off correction or if tomorrow’s payrolls would disappoint. Even so, we have the impression that the topside in EUR/USD is becoming tougher. EUR/USD might stay below the 1.1961/1.20 area ahead of next week’s Fed meeting, unless there comes high profile negative news from the US.

The day-to-day USD momentum is not too bad. Of late USD/JPY was quite sensitive to interest rates/differentials rather than to the gyrations in equity markets. Even so, the pair remains more vulnerable in case of risk-off.

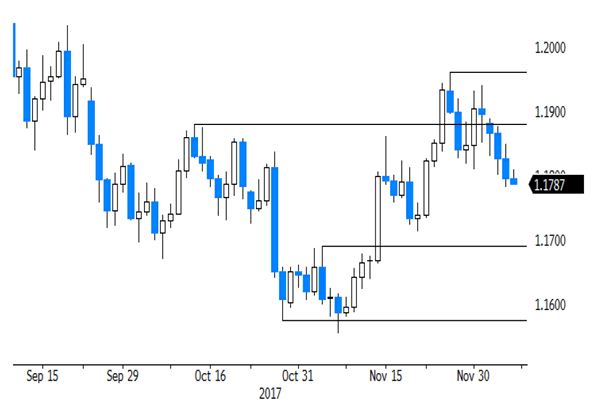

From a technical point of view: EUR/USD set a post-ECB low mid-November, but the dollar momentum wasn’t strong enough. EUR/USD settled in a directionless sideways consolidation pattern in the 1.18/19 area. A return below 1.1713 would signal that the rebound in EUR/USD is aborted. For now, there is no clear technical signal. USD/JPY’s momentum deteriorated early November, dropping below the 111.65 neckline. No aggressive follow-through selling occurred though. Last week the pair succeeded a nice rebound, calling off the downside alert. The pair hovers again in the 110.84/114.73 consolidation range. We amended our ST bias from negative to neutral.

EUR/USD: drifting sideways as USD momentum improves

EUR/GBP

Binary Brexit risk paralyses sterling trading

There were again plenty of headlines on Brexit and on UK politics yesterday. They brought little evidence that a deal could be reached anytime soon. However, the impact on sterling trading was modest. EUR/GBP settled north of 0.88, but no important technical level was broken. The pair closed the session at 0.8808 (from 0.8797). Cable declined back below the 1.34 barrier, but part of this move was due to cable mirroring the intraday decline of EUR/USD. The pair closed at 1.3393. So, sterling held up quite well, suggesting that markets still see a decent change of a last minute solution ahead of next week’s EU summit

The UK eco calendar only contains the Halifax house prices today, but this is no market mover. Brexit headlines/rumours will continue to drive GBP trading. UK PM May is said to prepare a new proposal on the issue of the Irish boarder. However, it is far from sure than a solution acceptable for all parties will be found today. So, more directionless trading in the major sterling cross rates might be on the cards. Investors will probably abstain from setting up new directional bets as long as the binary Brexit risk isn’t out of the way.

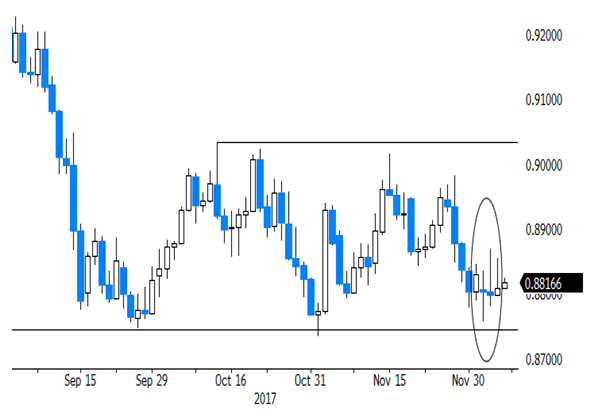

MT view/technical picture: A BoE driven sterling rebound ran into resistance early last month. Sterling declined again as markets anticipated that the rate cycle would be very gradual and limited. EUR/GBP trades in a 0.8733/0.9033 consolidation range. Brexit headlines cause day-to-day gyrations. We changed our ST bias on EUR/GBP from positive to neutral mid-November. The 0.9015/33 area might be tough to break short-term. In case of more positive news on Brexit, return action to the 0.8733 (or below) level is possible ST.

EUR/GBP going nowhere as markets await a clear sign from the Brexit debate