Friday August 18: Five things the markets are talking about

Aside from the terrorist activities in Spain, the uncertain U.S political environment is keeping the ‘mighty’ dollar pinned down atop of its G7 overnight lows.

Global equity indices have extended their slide after terrorists struck in Barcelona yesterday, intensifying the market’s unease initiated by growing concerns about dysfunction in U.S President Trump’s administration and U.S policy paralysis.

All strong reason’s why safe-haven bet trading is dominating the last session of the week.

1. Stocks see red on political woes

Yesterday, Wall Street’s major indexes slumped between -1.2% and -1.9%. The S&P 500 index posted its biggest drop in three-months. This set the tone for the overnight session.

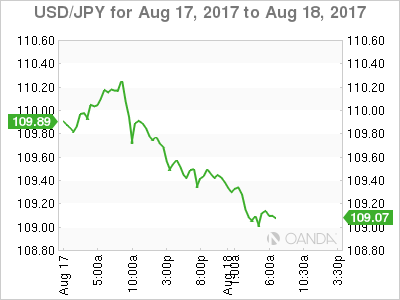

In Japan, equities hit a 3-1/2 month low on a stronger yen (¥108.98) and posted a fifth consecutive weekly drop. The Nikkei ended down -1.2%, its lowest close since May 2. For the week, it dropped -1.3%. Banks and financial shares underperformed, with the banking sub-index down -1.4% and the insurance sub-index losing -1.9%. The broader Topix declined -1.1%.

Down-under, Australia’s S&P/500 Index ended -0.6% lower. In South Korea, the Kospi index ended -0.1% lower, while Hong Kong’s Hang Seng Index fell -1.1%, while the China Enterprises Index lost -1.0%.

Note: Despite the losses, the Hang Seng index closed up +0.6% for the week thanks to support from companies reporting strong earnings.

In China, stocks were largely steady overnight, with investor optimism over strong corporate earnings and economic fundamentals offsetting pressure to book profits. The blue-chip CSI300 index closed out up +0.1%, while the Shanghai Composite Index was unchanged.

Note: The CSI300 gained +2.1% for the week and the Shanghai Composite rallied +1.9%, its best week in more than four-months.

In Europe, indices are trading sharply lower following on from the steep losses seen on Wall Street yesterday, with the French CAC and Spanish IBEX leading the declines. Yesterday’s terror attack in Spain is weighing on sentiment with Travel and Leisure stocks while there are further sharp falls in some of Europe’s major airlines.

U.S stocks are set to open in the red (-0.2%).

Indices: Stoxx600 -1.0% at 373.3, FTSE -1.1% at 7310, DAX -0.9% at 12093, CAC-40 -1.2% at 5083, IBEX-35 -1.2% at 10321, FTSE MIB -0.9% at 21601, SMI -1.0% at 8857, S&P 500 Futures -0.2%

2. Oil steadies as high U.S output balances crude stock draw, gold higher

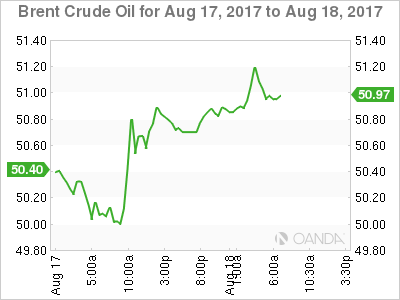

Ahead of the U.S open, oil prices trade somewhat steady after this week’s U.S inventory data showed a big fall in crude stockpiles, but also an increase in production to its highest in more than two-years.

Global benchmark Brent is down -0.1% to +$50.99 a barrel, after jumping +1.5% yesterday on a drop in U.S stocks – it is on track for a -2.15% decline for the week. U.S light crude (WTI) is down -0.1% to +$47.05, surrendering some of Thursday’s +0.7% gain and heading for a -3.6% weekly loss.

This week’s EIA data showed commercial U.S crude stocks had fallen by almost -13% from their peaks in March to +466.5m barrels. Stocks are now lower than in 2016.

But U.S oil output is rising fast as shale producers take advantage of a recent increase in prices – production jumped by +79k bpd to over +9.5m bpd last week, its highest level in two-years.

Note: Rising U.S output continues to undermine efforts by OPEC and non-OPEC producers to drain a global fuel glut.

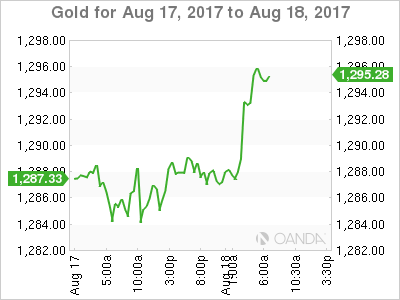

Spot gold is steady at +$1,286.85 an ounce, holding most of Thursday’s +0.4% gain. It is set to end the week down -0.1%.

Elsewhere, industrial metals, which posted multi-year highs this week, is waning as investors take profit – copper futures are down -0.3% to +$6,468.50 a tonne, extending yesterday’s -0.6% drop. Benchmark zinc set a new 10-year high of $3,147 a tonne yesterday.

3. Yields fall on terror worries

Geopolitical risk, protectionism and the unwinding of easy central bank money continues to support sovereign bond prices.

Investors seem content to flock into German and U.S Treasury bonds as the appeal of riskier assets flounders due to events in Spain and Washington.

Sovereign yields have fallen in recent days following the ECB comments and amid the dash for defensive assets – 10-year German Bunds are trading at a one-week low of +0.41% while U.S 10-year Treasuries trade just off their one-week lows hit yesterday at +2.19%.

Elsewhere, U.K’s 10-year Gilt yield has fallen -1 bps to +1.075%.

4. Turmoil, Terror weighs on stocks and dollar

U.S political uncertainty is keeping the dollar pinned down atop of this weeks lows.

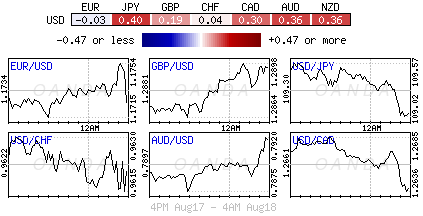

Overnight, the ‘mighty’ dollar is down more than -0.4% against the AUD (A$0.7921), NZD (NZ$0.7324) and off -0.2% against CHF ($0.9630) and the pound (£1.2907).

It’s no surprise to see the yen (¥108.95) as the major mover among the G10 group of developed world currencies, gaining another +0.5% outright as nerves over stock market valuations and geopolitical concerns edge to the fore.

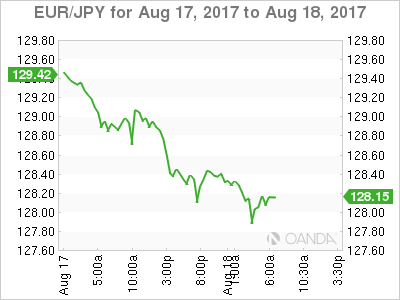

The EUR (€1.1742) had recovered all of the ground it lost after ECB policymakers warned of an “overshoot” in the currency in the minutes from last month’s policy meeting.

Despite a recovery in the last fortnight, the dollar index is still just +1% above its 13-month lows hit at the start of this month.

5. Eurozone Current Account Surplus Shrank in June

Data this morning showed that the eurozone’s current-account surplus narrowed in June.

The current-account balance stood at a surplus of +€21.2Bin June, following +€30.5B in May. In the 12-month period to June, the current-account surplus stood at +3.1% of GDP vs. +3.5% one year earlier.

Compared to the previous month, the surplus in goods increased from +€26.6B to +€27.4B. The surplus in services declined to +€2.2B from +€2.7B.

The surplus in primary income fell to +€4.6B from +€11.3B, while the deficit in secondary income expanded to +€13B from +€10.1B.