Today, the US employment report for July will take center stage. The forecast is for nonfarm payrolls to have risen by 183k, less than the 222k in June, but still a number consistent with further tightening in the labor market. The unemployment rate is expected to have ticked back down to 4.3%, while average hourly earnings are forecast to have accelerated in monthly terms. Overall, this looks like another strong employment report, which could revive some expectations for another Fed rate hike this year (that probability is currently 45% according to the Fed funds futures) and thereby, help the dollar recover some of its latest losses.

However, we think that the main determinants of whether the Fed will indeed proceed with another hike this year are inflation data. The latest prints showed that headline inflation slowed for the 4th consecutive month, while the core rate remained unchanged after falling for 4 months in a row as well. In our view, a strong rebound in inflation is needed before rate-hike expectations rise materially and help the dollar reverse its latest downtrend.

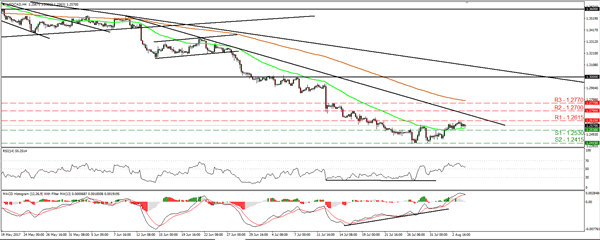

USD/CAD traded in a consolidative manner yesterday, staying between the support of 1.2530 (S1) and the resistance of 1.2615 (R1). Having in mind that the rate is still trading below the short-term downtrend line taken from the peak of the 9th of June, we consider the short-term downtrend to still be intact. However, the rate failed twice to break below 1.2415 (S2) recently, while there are expectations of solid US employment data later in the day, and a neutral Canadian jobs report (see below). All these make us believe that there is a decent probability for the pair to trade higher today, and perhaps break above the aforementioned short-term downtrend line. A break above that line and 1.2615 (R1) may initially aim for our next resistance of 1.2700 (R2).

Switching to the daily chart, although a break above the short-term downtrend line may signal a short-term trend reversal, as long as the rate is trading below the psychological zone of 1.3000, we consider the broader outlook to be cautiously negative. We would treat a possible short-term reversal as a corrective rebound.

BoE signals little urgency for a near-term hike; GBP tumbles

The BoE kept its policy unchanged yesterday via a 6-2 vote, as was anticipated. Even though the Bank reiterated that policy may need to be tightened to a somewhat greater extent over the next 3 years than what is currently implied by market pricing, it signaled little urgency for a hike in the next few months. In addition, it revised lower its inflation and economic growth forecasts. The Bank’s neutral tone, combined with the downgrade in the forecasts, likely disappointed investors looking for hawkish signals that a rate hike is imminent. The fact that the vote was 6-2 may have also been seen as a negative surprise, as some may have expected Haldane to join the hawks and vote for a hike too. The result was a weaker sterling.

As for the pound’s forthcoming direction, in the absence of any Brexit headlines to guide the currency over the next few days, movements in GBP crosses are likely to depend primarily on the pound’s counterparts. Specifically, GBP may continue to gain against the weak USD, but perhaps remain on the back foot versus the almighty EUR.

EUR/GBP surged yesterday on the BoE decision. The rate emerged above the psychological barrier of 0.9000 (S1), to challenge our next hurdle of 0.9050 (R1). Given that yesterday’s rally confirmed a forthcoming higher high, we believe that the outlook remains positive. We would expect a decisive break above 0.9050 (R1) to open the way for our next resistance of 0.9125 (R2). Nevertheless, bearing in mind that the BoE surge appears overextended, we are mindful of a corrective retreat due to some profit taking. Such a retreat may challenge the 0.9000 (S1) territory as a support this time before the bulls decide to shoot again.

As for the rest of today’s highlights:

Besides the US jobs figures, we get employment data for July from Canada as well. The forecast is for the unemployment rate to have remained unchanged, while the net change in employment is expected to have declined, but to remain in positive territory. In such a case, the reaction in CAD may be relatively limited. That said, we should stress that we view the risks surrounding CAD’s forthcoming direction as being asymmetrical. Market pricing currently suggests that another BoC rate hike by year-end is fully priced in. Therefore, if economic data and developments are encouraging over the next months, they would only confirm the current sentiment and may thus have little positive impact on CAD. On the other hand, in case economic indicators deteriorate, expectations for a hike could quickly decline, leading to a significant downside correction in CAD.

As for the speakers, BoE Chief Economist and MPC member Andy Haldane will deliver remarks.

USD/CAD

Support: 1.2530 (S1), 1.2415 (S2), 1.2360 (S3)

Resistance: 1.2615 (R1), 1.2700 (R2), 1.2770 (R3)

EUR/GBP

Support: 0.9000 (S1), 0.8975 (S2), 0.8920 (S3)

Resistance: 0.9050 (R1), 0.9125 (R2), 0.9235 (R3)