Key Points:

- The PLNUSD has been powering higher over recent weeks.

- Technically, the pair is well placed to rally further.

- USD weakness will only help to spur the bulls into action.

Just for something different, we are looking at the Polish Zloty today as the currency has been making some solid gains on the greenback and it looks as though it could extend further still. Indeed, this exotic cross has been powering higher over the past few months – on par with even the Swiss Franc’s solid performance.

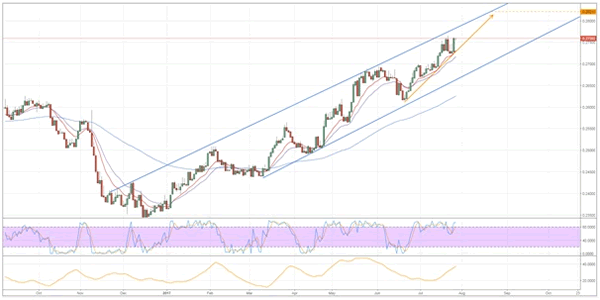

From a technical perspective, it’s easy to see why further gains are expected for this highly bullish pair. As shown below, the EMA bias is in the most bullish configuration possible and in little danger of seeing a shift in momentum any time soon. Additionally, momentum indicators such as the ADX are certainly suggesting that a very strong trend is in play which means it would likely take a decent fundamental upset to slow the accent.

What’s more, whilst it is currently bearish, the parabolic SAR reading is on the cusp of inverting to bullish which could mean that we don’t see the pair cool off for some time. Instead, we could see yet another push higher before the PLNUSD decides to return to the downside of the channel. Of course, this largely makes sense as the pair hasn’t managed to fully test the upside constraint of the broader ascending channel since May.

If we do continue to see the pair advance, the Zloty could eventually reach as high as the 0.2821 mark over the next few weeks. At this point, there is a very distinct chance that it will be highly oversold and in need of a slip back to support. Exactly how far it will stumble is not yet clear, nevertheless, it should be able to hold above the 0.2750 level without too much trouble.

Ultimately, the outlook is fairly good for the PLNUSD moving forward and we can expect to see it enjoy the market’s favour. This will especially be the case as the USD remains besieged by negative sentiment stemming from political turmoil in the US and recently refreshed concerns that the Fed cannot deliver on its long-touted rate hikes.