Today, all eyes will be on the FOMC rate decision. The forecast is for no change in policy. This is one of the smaller meetings that are not accompanied by updated projections or a press conference by Chair Yellen. As such, all of the action will come from the language of the statement accompanying the decision.

Economic data following the Fed’s June policy meeting have been disappointing on balance. Headline inflation continued to slow in June for the 4th consecutive month, while retail sales for the month declined for the second time in a row. Even though the labor market continued to tighten, we doubt that will be enough to comfort policymakers, given that wage growth remains lackluster.

Bearing these in mind, we think that the statement accompanying the decision may have a slightly more cautious tone than previously, acknowledging the recent softness in the data, particularly in inflation. Something like that could weigh on USD. Even though the statement may suggest once again that the data weakness is transitory and that inflation is expected to recover soon, we find it difficult to envision a scenario in which policymakers appear optimistic enough to bring rate-hike expectations forward and trigger a rebound in USD.

As for the balance sheet, market chatter suggests the Committee could signal that its reduction is drawing closer, thereby preparing the ground for a September announcement. However, we believe such a change in language is unlikely. The FOMC rarely commits to action at a specific meeting beforehand, and considering the recent streak of soft data, policymakers may prefer to leave themselves some room for maneuvering.

EUR/USD spiked up at around midday in Europe, but hit resistance at the 1.1710 (R1) important barrier and slid to give back all its gains. Although the prevailing trend remains positive, the pair has been oscillating between 1.1615 (S1) and 1.1710 (R1) for the last couple of days, waiting for today’s FOMC decision. If indeed the Fed appears more cautious, we expect the bulls to pull the trigger for another test near 1.1710 (R1). Having said that though, we would like to see a decisive close above that obstacle before we get confident on larger upside extensions. The 1.1710 (R1) level has been acting as the upper bound of the long-term sideways range that has been containing the price action since January 2015 and as such, its break may turn the major picture to the upside.

AUD pulls back on slowing inflation and Lowe’s neutral tone

AUD took a hit overnight, after data showed that Australia’s CPI slowed in Q2, missing its forecast for a slight acceleration. A couple of hours later, RBA Governor Lowe stepped up to the rostrum. His tone was neutral overall, noting that some people got overly excited about the discussion around the neutral rate at the last RBA meeting. With regards to AUD, he simply noted that it would be better if it was a bit lower than now. Coming on top of the slowdown in the CPI, his neutral remarks probably poured cold water on speculation that the Bank may raise rates soon.

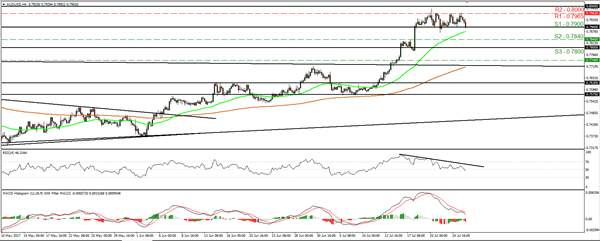

AUD/USD traded lower on these developments and at the time of writing, it is testing the 0.7900 (S1) barrier, which is acting as the lower boundary of the sideways range that has been containing the rate since the 17th of July. A dip below 0.7900 (S1) may pave the way towards our next support barrier of 0.7840 (S2). However, even though the pair may continue to correct lower in the next days, as long as it remains above the key hurdle of 0.78000, we believe that the outlook remains cautiously positive.

That said, we would stay mindful ahead of next week’s RBA meeting, as the statement accompanying the decision may communicate a greater discomfort with regards to the latest appreciation of AUD. After that, wage data for Q2 due out in mid-August could play the biggest role in shaping market expectations with regards to the timing of the first RBA hike, thereby dictating the Aussie’s general direction.

As for the rest of today’s highlights:

During the European day, the 1st estimate of UK GDP for Q2 is due out. Expectations are for growth to have accelerated slightly to +0.3% qoq from +0.2% qoq in Q2. The forecast is supported by the NIESR GDP estimate, which also shows growth ticked up to +0.3% qoq. Accelerating growth may support sterling somewhat, but such a print is unlikely to boost market expectations regarding a BoE rate hike this year.

EUR/USD

Support: 1.1615 (S1), 1.1585 (S2), 1.1485 (S3)

Resistance: 1.1710 (R1), 1.1880 (R2), 1.1980 (R3)

AUD/USD

Support: 0.7900 (S1), 0.7840 (S2), 0.7800 (S3)

Resistance: 0.7965 (R1), 0.8000 (R2), 0.8070 (R3)